Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've recently taken over reconciling our bank statements from someone who has left the company.

The last reconciliation she did was for 12/31/19, and included an adjustment of -$54 to get recon difference to $0. Now when I try to reconcile the 1/31/20 statement, I end up with a difference of $54.

I have since found the problem with the 12/31/19 reconciliation, which was a check transaction that was never entered in QBO. I would like to get rid of the adjustment she did for the last recon. and then just entering the missing transaction in the register. But I'm not sure if this will fix it or if it's the best way to do it.

How can I move forward in 2020 without having to put another adjustment in my first reconciliation?

Hi there, wmobrien,

I'm glad to help correct the reconciled account on 12/31/19.

Let's start by deleting the adjustment entry so you won't see it on the next reconciliation. To do so, you'll want to run the Transaction List by Date report and delete it from there. This report lists all transactions with Reconcile Adjustment in the Memo field within the specified date range.

Here's how:

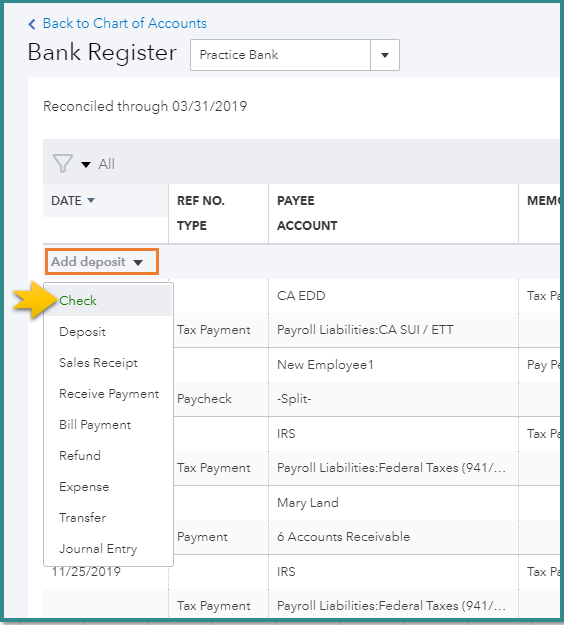

Once done, enter a check through the register and make sure the date is under the 12/31/19 statement. This is to ensure you have a correct balance on your register.

I'm glad to walk you through the steps:

Here are your resources to help manage your books in QuickBooks Online:

Keep me posted if there's anything else you need. I'm always around to help you with any QuickBooks issues you may be having.

Thank you and stay safe!

Hi MaryLandT -

Thanks for the instructions. I am, however, having trouble in step 7 of deleting the adjustment. When I try to delete the adjustment entry (either by clicking the trash can or the "Clear all lines" button), I get an error message when I try to save and close the window. The error message says, " ! Something's not quite right Please enter at least one line item."

I can send you a screen shot if that helps you diagnose the issue. Thanks.

Thank you for getting back to us here on the Community page, @wmobrien.

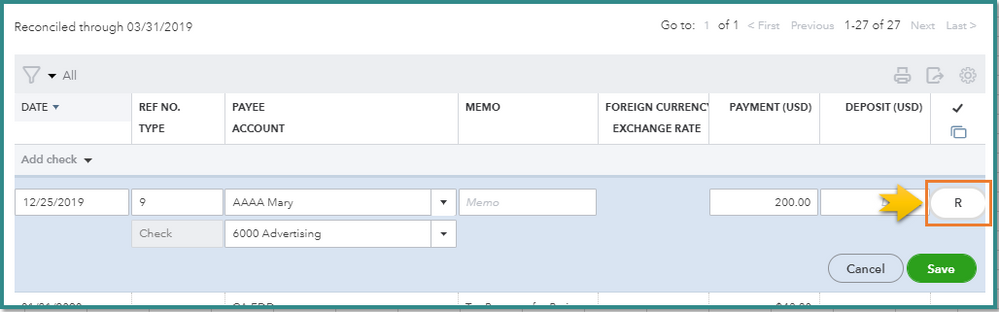

You'll receive this error if you've clicked on the Delete icon beside the Reconciliation Discrepancies line item. To delete the adjustment successfully, select Delete from the More button.

This screenshot shows you the visual reference.

Get back to me if you have any other questions. I'm always here to help. Have a good day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here