I'm here to show you how to record a vendor refund, gjsinop.

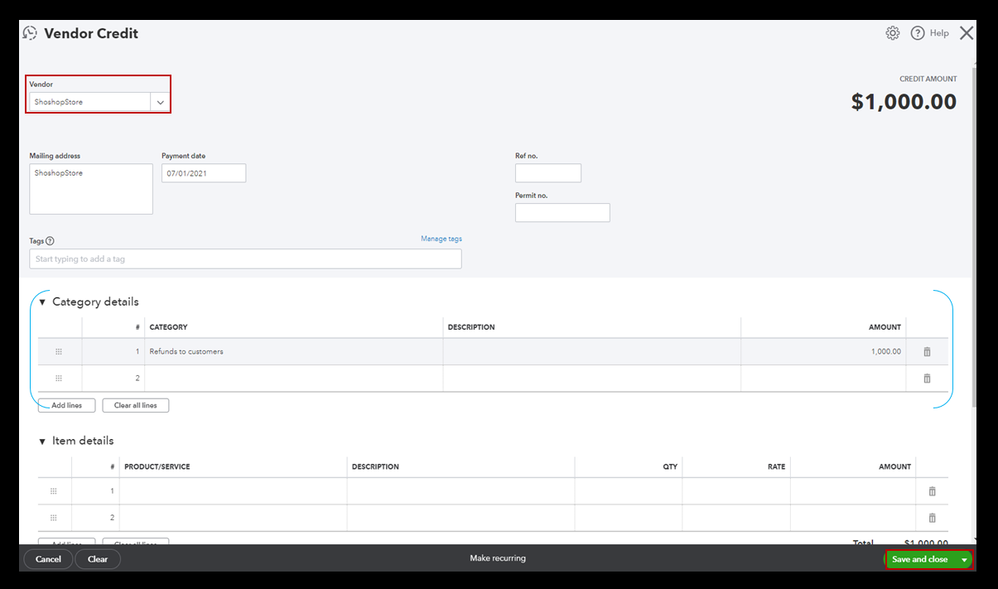

To start, we'll have to enter a vendor credit. This ensures the credit hits the expense account you use for this vendor.

- Go to + New.

- Select Vendor credit.

- In the Vendor drop-down menu, select your vendor.

- Enter the necessary details.

- Once done, click on Save and close.

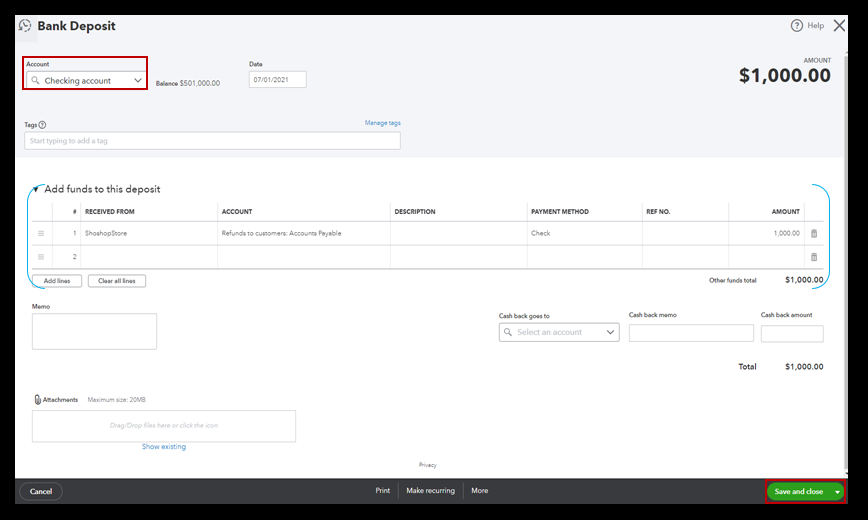

Then, let's deposit the money you got from the refund in QuickBooks. Here's how:

- From + New, select Bank Deposit.

- In the Account drop-down menu, select the account where you got the refund.

- In the Add funds to this deposit section, fill out the following fields.

- Received from: Select the vendor who gave you a refund.

- Account: Select Accounts Payable. Important: You need to pick Accounts Payable so you can tie the refund to the vendor credit. This may seem a little strange, but it’s the best way to do this.

- Payment method: Enter the method your vendor used to refund you.

- Amount: Enter the amount of your refund.

- Select Save and close.

Once done, use Pay Bills to connect the bank deposit to the vendor credit. Even though you aren’t paying a bill, this keeps your vendor expenses accurate.

- Select + New, then Pay Bills.

- Choose the bank deposit you just created.

- You’ll see the amount of the vendor credit in the Credit Applied field. The Total payment should be $0.00.

- After that, click on Save and close.

Additionally, I'm adding these articles about entering a vendor credit and applying them to your transactions as future references:

Please come back and keep us posted on your progress in recording the vendor refund. I'm determined to get all your transactions recorded in QuickBooks.