Your engagement with the Community forum is appreciated, krys. We value your time and effort in reaching out to us. Together, we'll determine the causes behind the identical payment amount appearing as both a withdrawal and a deposit in QuickBooks. Through our joint efforts, we can identify the root cause and guarantee that your financial information is represented in the software accurately.

When identical amounts appear as both a deposit and withdrawals in your account, you may likely have used your personal funds to handle your compensation. This often indicates that payroll processing occurred through an individual's account rather than a designated business account. Generally, it's best to keep your business and personal finances separate. One of the initial and recommended steps when launching a new business is setting up a dedicated business checking account.

In this case, I suggest reviewing the payroll setup within the system to guarantee they are configured accurately. Ensure the bank account for payroll transactions is set to your business account, not your personal account. Check if you have accidentally linked your personal bank account to QuickBooks for payroll purposes.

Here's how you can verify:

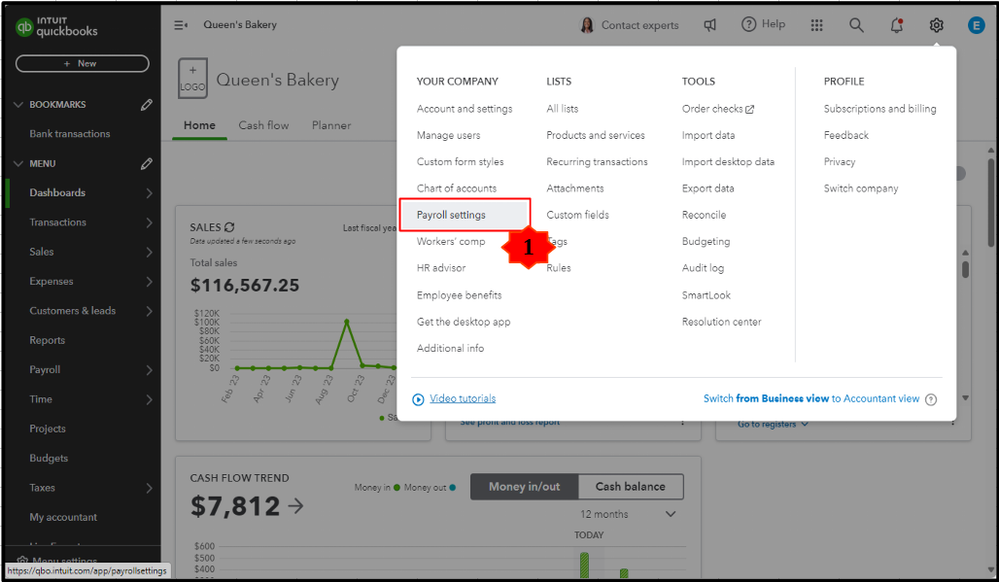

- Go to the Gear icon and choose Payroll settings.

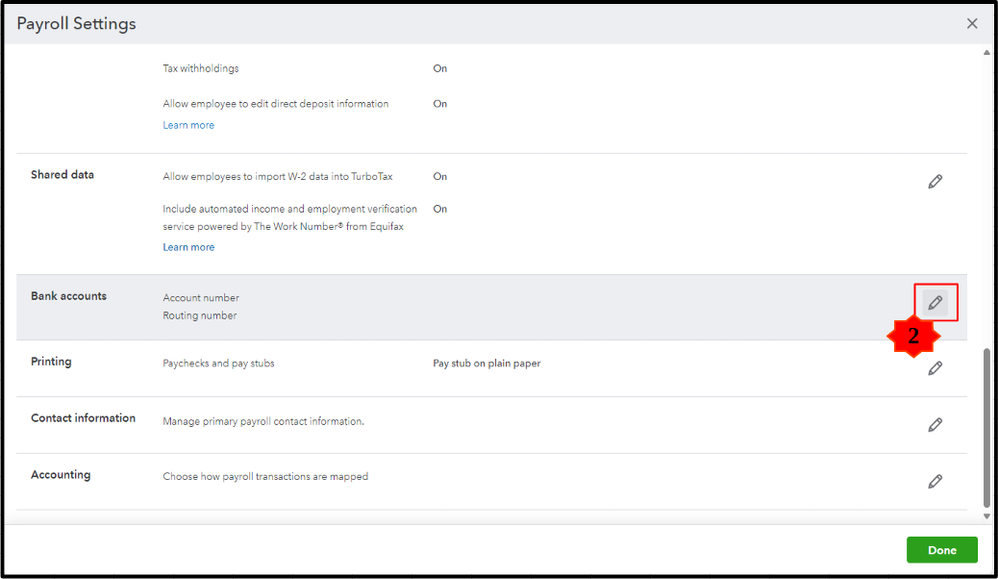

- On the Bank accounts section, hit the Pencil icon.

- Enter the necessary changes.

- Once done, click Save and continue.

If you've used your personal account in processing your payroll, check out this article for guidance on recording these transactions: Mixing business and personal funds in QuickBooks Online.

You can leave a comment if you have any further inquiries about managing payroll transactions and handling personal funds within QuickBooks Online (QBO) or other related tasks such as processing payroll transactions or integrating personal finances seamlessly. I'm here to assist you, so don't hesitate to reach out. Take care, and I look forward to helping you streamline your accounting processes with QBO, krys.