Hi there, stephredford,

I'm here to help get this moving in the right direction towards fixing the reconciliation discrepancy.

You can undo the previous reconciliation since you've already voided the bill payment. This is to help ensure your books are accurate.

Here's how:

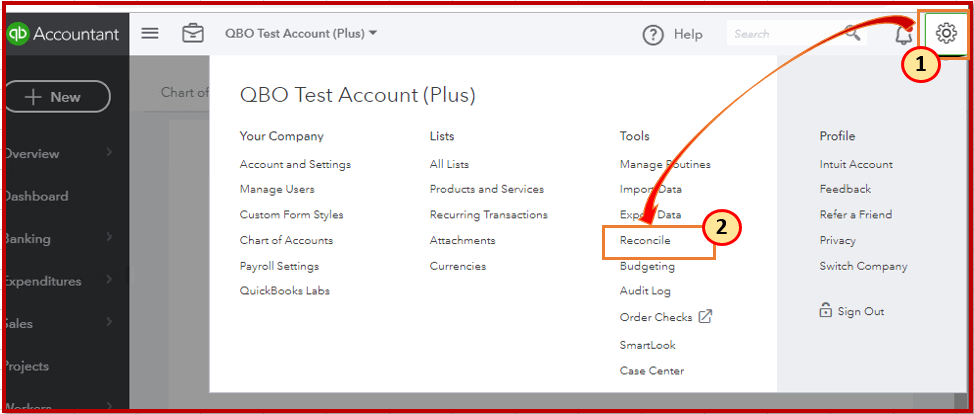

- Go to the Gear icon at the right top.

- Select Reconcile under Tools.

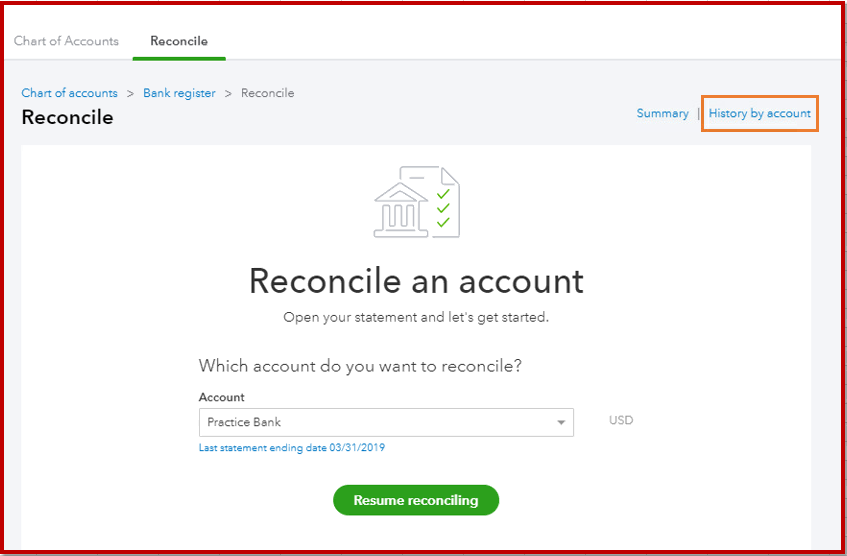

- On the Reconcile an account page, select History by account.

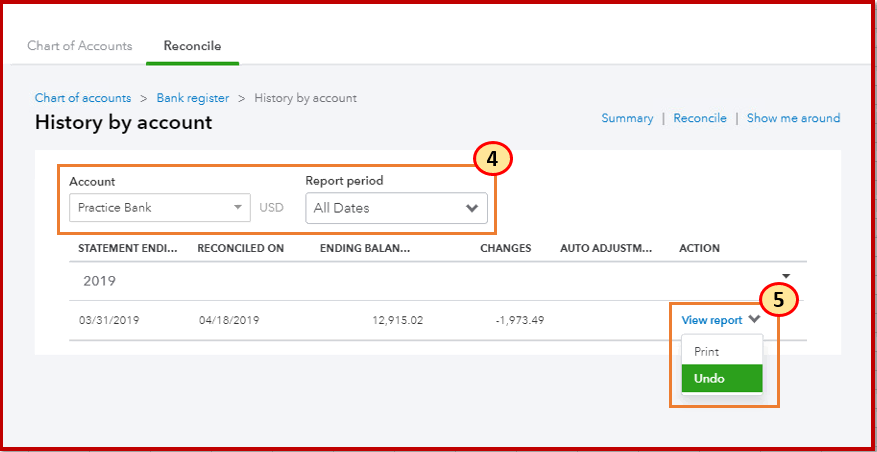

- Choose the reconciled Account and Report period to locate the account you want to undo.

- Choose Undo under the Action column.

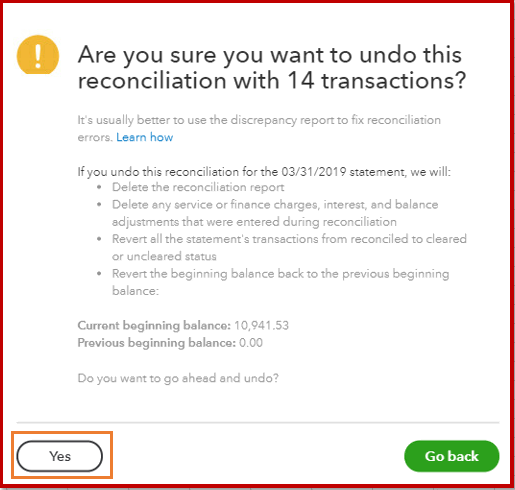

- Click Yes.

- In the final confirmation window, pick Undo and OK.

If the Undo option isn't available, that means you don't have the accountant version of QuickBooks. You need to manually unreconcile those transactions.

Let me show you how:

- Go back to the Gear icon.

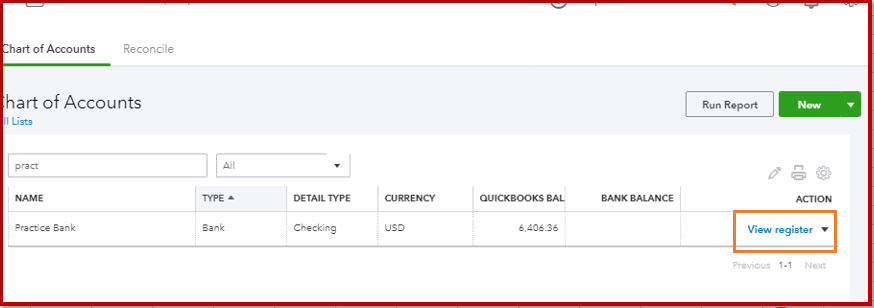

- Pick Chart of Accounts under Your Company.

- Locate the appropriate account for the transaction and select View Register under Action.

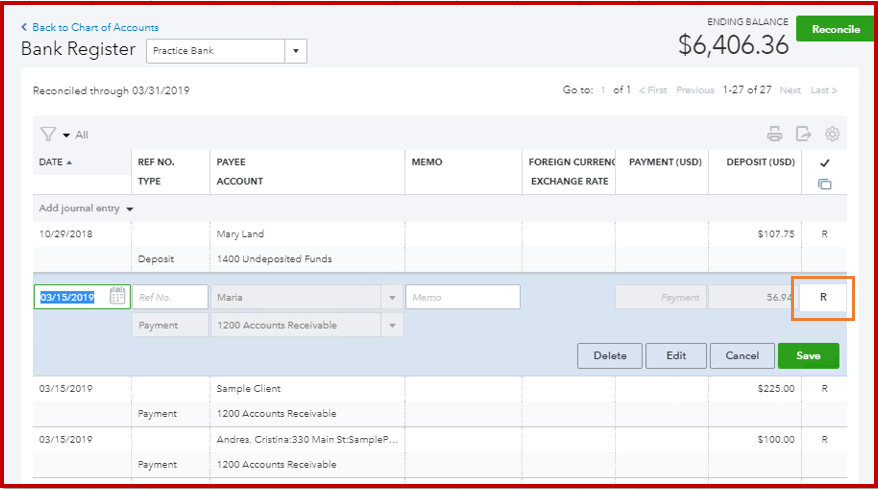

- Identify the transaction to edit.

- In the reconcile status column (indicated by a check mark), repeatedly click the top line of the transaction to change the status. This shows the “R” status.

- Click Save.

After that, you can then start reconciling them again. Feel free to use this article for the detailed steps: How to Reconcile an Account in QuickBooks Online.

Upon sharing the solution above, I still suggest consulting with an accountant. He/She might have specific instructions on how to properly handle the discrepancies.

I've also added this link: Resolve reconciliation differences for the expert tips on how to get the difference to zero when reconciling an account in QuickBooks.

Let me know if you need any other help along the way, and I always have your back.