Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat would be the best way to record a cash transfer from an external account that is not tracked in Quickbooks, and is not intended to be tracked in Quickbooks?

For background: we have operating accounts for a family office that are externally managed, which transfer funds to accounts we manage. What is the best method to record this inflow of cash?

Solved! Go to Solution.

"For background: we have operating accounts for a family office that are externally managed, which transfer funds to accounts we manage. What is the best method to record this inflow of cash?"

Is the external account a business account? If so, they are assets of the business. Do you have those assets recorded somewhere else on some other balance sheet? If so, assign the same account to the transfer in that you assigned to the transfer out on the other balance sheet.

If you don't have those funds on another balance sheet, then that's an issue. This should be a simple account transfer between business accounts- Account A decreases (credit) by, say, $50K, and Account B increases (debit) by $50K.

If the external account isn't a business account, then assign the appropriate owner's/shareholder's/partner's equity account to the deposit in QB.

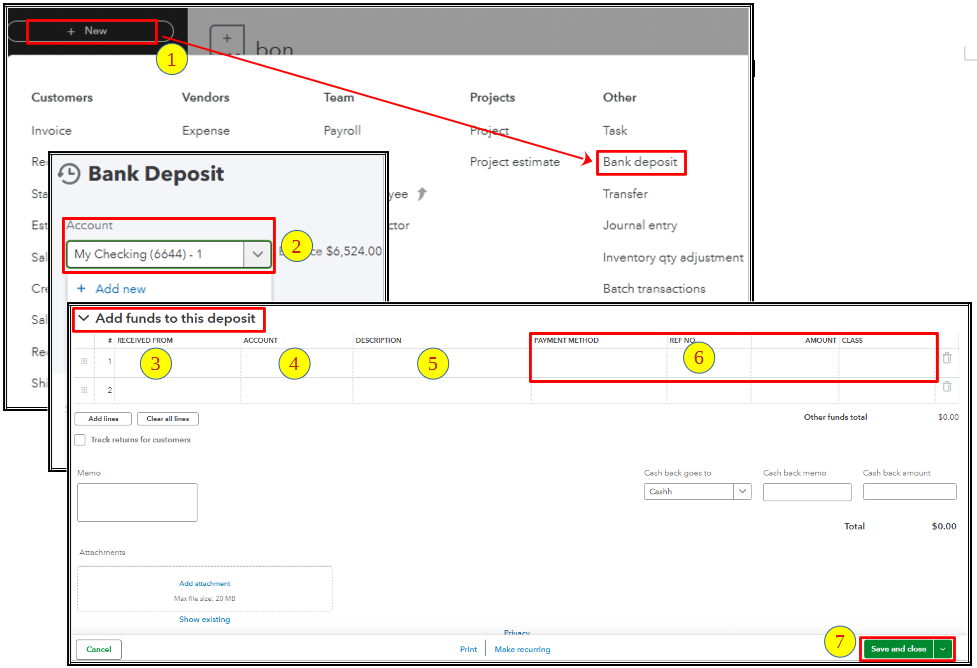

Hello there, ZRaza. You can consider using the Bank deposit feature of the program to record the inflow of cash and for the external account, you can refer to an accountant for guidance. I'm here to guide you through the steps.

Here’s how you can record the incoming cash transfer:

Please refer to this article for more details of the deposit process: Record and make bank deposits in QuickBooks Online.

Moreover, to enhance your QuickBooks experience, consider collaborating with our QuickBooks Live Expert Assisted team. These financial professionals specialize in streamlining processes and providing tailored advice to meet your business's unique needs.

Additionally, ensure to reconcile your accounts regularly to keep them accurate and up-to-date.

If you have other questions or need further assistance with the process, our Community forum is available 24/7, ZRaza. Wishing you a productive day ahead.

"For background: we have operating accounts for a family office that are externally managed, which transfer funds to accounts we manage. What is the best method to record this inflow of cash?"

Is the external account a business account? If so, they are assets of the business. Do you have those assets recorded somewhere else on some other balance sheet? If so, assign the same account to the transfer in that you assigned to the transfer out on the other balance sheet.

If you don't have those funds on another balance sheet, then that's an issue. This should be a simple account transfer between business accounts- Account A decreases (credit) by, say, $50K, and Account B increases (debit) by $50K.

If the external account isn't a business account, then assign the appropriate owner's/shareholder's/partner's equity account to the deposit in QB.

I have recorded it as a partner's equity account, and wanted to confirm this makes the most sense. Thank you!!

We set up an external account transfer from bank A. Bank A transferred $.05 money into Bank B without using funds from bank A account. How would you account for the amount transferred into bank B.

Thanks for getting involved with this thread, slowlearner2. I appreciate your detailed information.

To properly identify how you would account for an amount you transferred from one account to another, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form.

I've also included a detailed resource about working with transfers which may come in handy moving forward: Transfer funds between accounts

I'll be here to help if there's any additional questions. Have a wonderful Wednesday!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here