Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYou can match sales and fees on the Banking page depending on how you recorded the transactions in QuickBooks Online (QBO). Allow me to provide the details below.

If you recorded sales with fees included as a line item in the deposit, match only the sales transaction with the deposit and exclude the fees on the Banking page, as they're already part of the matched deposit.

To match:

To exclude the fees:

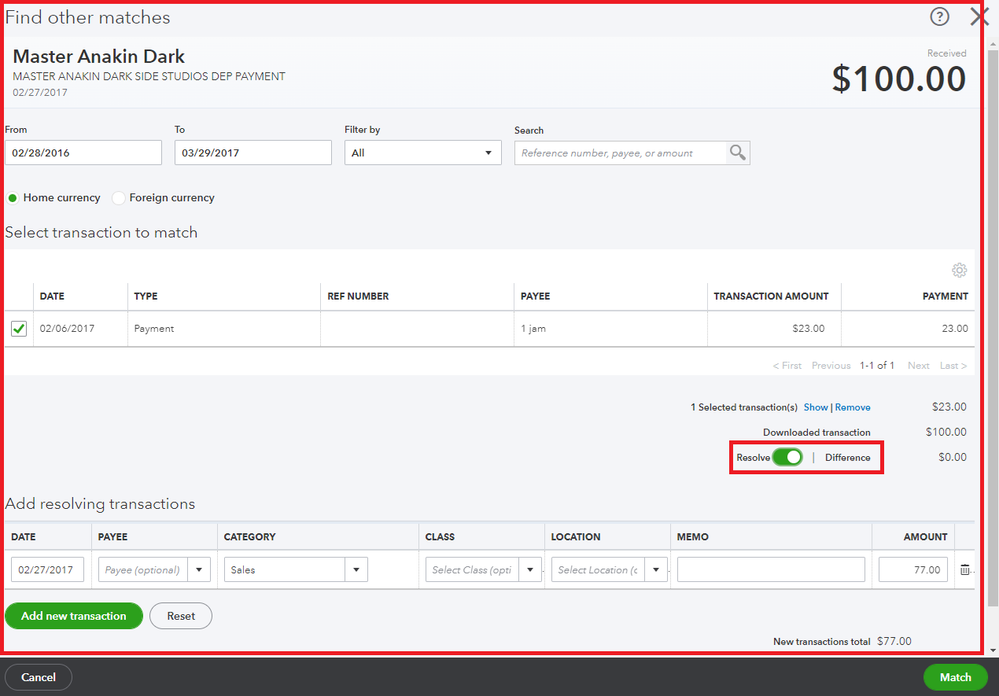

If you've recorded the sales amount without the fees included in QBO, you can still match it and use the Resolve Difference feature to account for the fees. Ensure to post the difference to the appropriate expense account you use for tracking the fees.

Here's how:

Additionally, you can check out these articles for more details on matching and categorizing your transactions in QuickBooks:

Furthermore, you can read through this material for future reference in reconciling accounts to always match your bank and credit card statements: Reconcile an account in QuickBooks Online.

Don't hesitate to click the Reply button if you need clarification on matching your sales and fees transactions in QuickBooks. I'm always here to help you.

Hello! We also recently began using Squarespace for payment processing (in addition to Square) and have connected to QBO. May I ask which app you're using to integrate Squarespace with QBO? I've tried both QB Connector and Saasant's Paytraqer and both aren't able to 1) collect bank payout data and 2) fees. It's been such a pain and so different from the experience with Square! Thank you for sharing.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here