Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen will QB update the Indiana state withholding rate to 3% for 2025?

Experiencing the same issue here in Louisiana. QB Payroll update still has not been provided for our State WH tax change that are supposed to be in effect as of 1/1/2025 and they are not. Spent the last two weeks calling and chatting with QB Intuit as well as the LA Dept of Rev to get resolve and still nothing from either.

QuickBooks hasn't yet integrated the updated tax table for Indiana state withholding tax for 2025, ckhart. Nevertheless, rest assured that our compliance team is diligently working to ensure our payroll services are in complete accordance with your state's revised withholding table and formula.

The last payroll update (22501) was released on December 19, 2024. For more details on what was included in the update, refer to this article: Get latest payroll news and updates in QuickBooks Desktop Payroll.

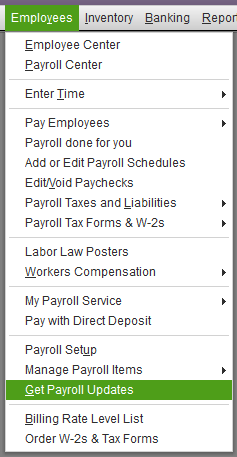

Since staying compliant with taxes and paycheck calculations is essential, let me provide the steps for downloading the latest tax table once it's available.

For a deeper dive into getting the newest tax table in QuickBooks, refer to this article: Get the latest tax table update in QuickBooks Desktop Payroll.

If you ever need to update your state unemployment rate, here's a comprehensive resource for updating it manually: Update your State Unemployment Insurance (SUI) rate.

I'll also include this guide on filing your tax forms with QuickBooks for your convenience: E-file and e-pay federal forms and taxes in QuickBooks Desktop.

This thread is always open for you to return to if you have more questions or need further assistance ensuring your payroll is accurate and compliant. I'm here to ensure you have everything you need to stay on top of your finances.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here