I’m happy to see you today, michellek22.

Let me welcome you to the Intuit Community. Allow me to share some information about setting up a deduction item in QBO.

The option to automatically set up the 401K to take out the amount per hour is currently unavailable. As a workaround, every time you run payroll manually enter the amount under the 401K box.

If you haven't set up the payroll item, I've laid out the steps on how to accomplish this.

- In your QBO company, go to the Workers panel.

- Select Employees.

- On the Employees page, choose the employee you’re working on.

- Click on the Pencil icon for Pay.

- In the Pay column, go to the Does employee have any deductions? section.

- Click on the Add a new deduction link.

- Enter the provider's name in the field box.

- For the employee deduction, select the $ amount in the Amount per pay period drop-down.

- For the company contribution, you can follow the same steps above.

- Enter a dummy number to complete the setup. You can always override the amount every time you run payroll.

- Click on OK.

Just in case, check out the Add, edit, and delete a payroll deduction item article for more information.

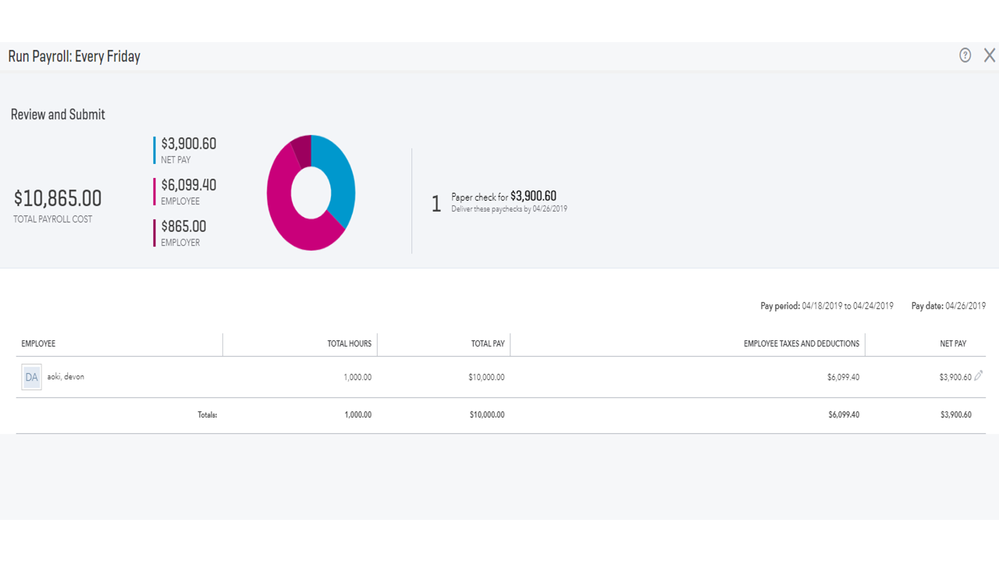

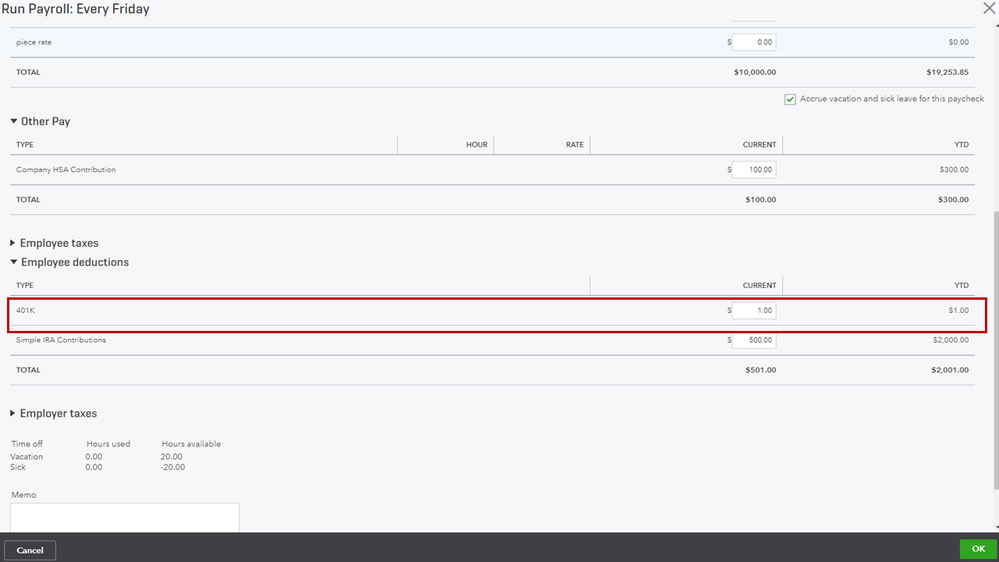

Once you create a paycheck, you’ll have to open it and enter the correct amount. Let me walk you through the process.

- On the Run Payroll page, click on the Pencil icon for Net Pay.

- Go to the Employee deductions section.

- Under Current, input the correct figure.

- Click on OK.

This information should help you move forward.

Keep me posted on how this goes after following these steps. I’ll be right here to assist further.