Thanks for dropping by the Community, SR Smith.

We’ll have to open the Payroll Summary and Payroll Liability Balances Reports to determine which quarter the $70 come from. Then, compare the total 941 taxes deducted to the total payments send out.

When you build the report, select a per quarter date range to get the correct wages, taxes, payroll additions, and deductions for that period. Here's how to open the Payroll Summary Report.

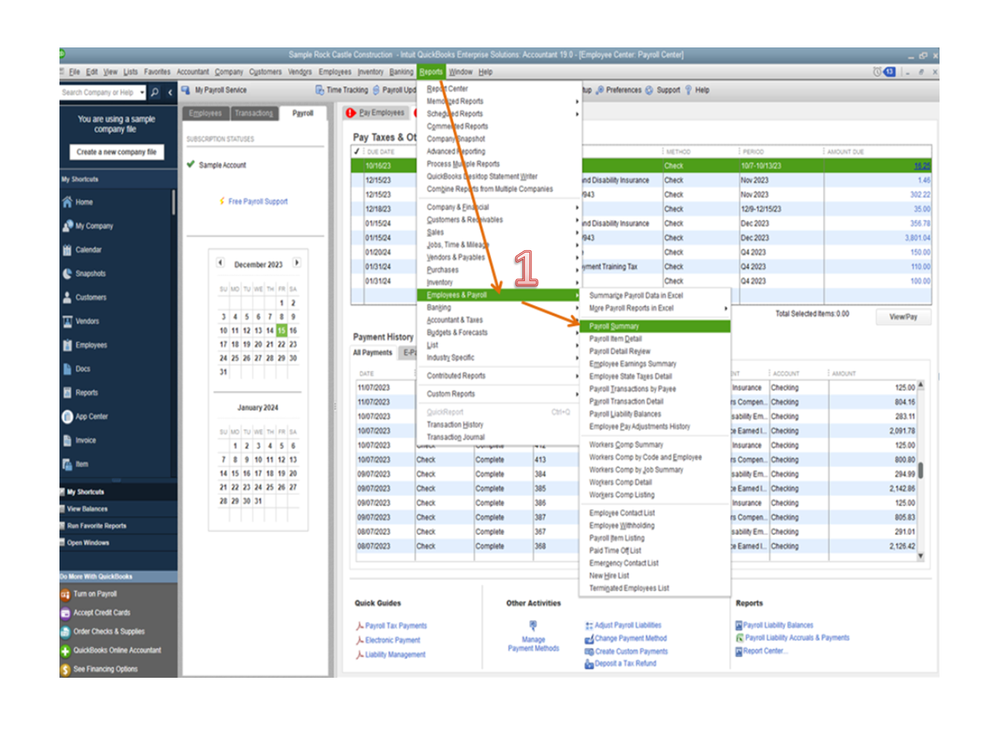

- Go to the Reports menu at the top and choose Employees & Payroll to select Payroll Summary.

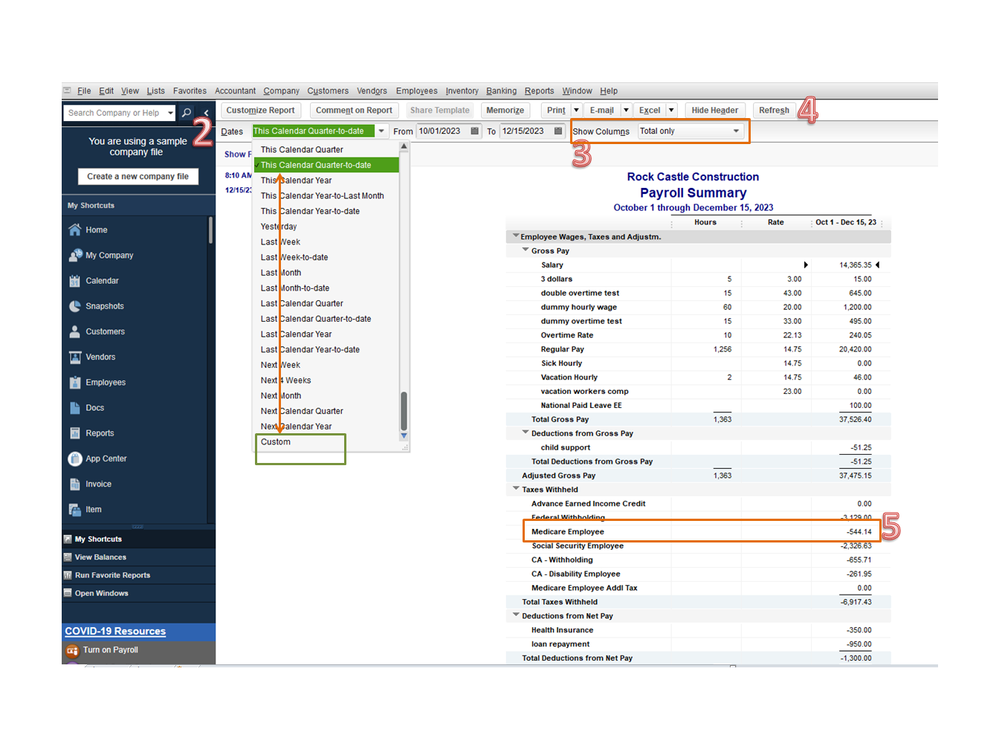

- From the Dates drop-down, pick the specific quarter or Custom to enter a specific range.

- In the Show Columns section, click the drop-down to select Total only.

- Hit the Refresh button.

- Next, click the amount for your payroll taxes to view the complete details.

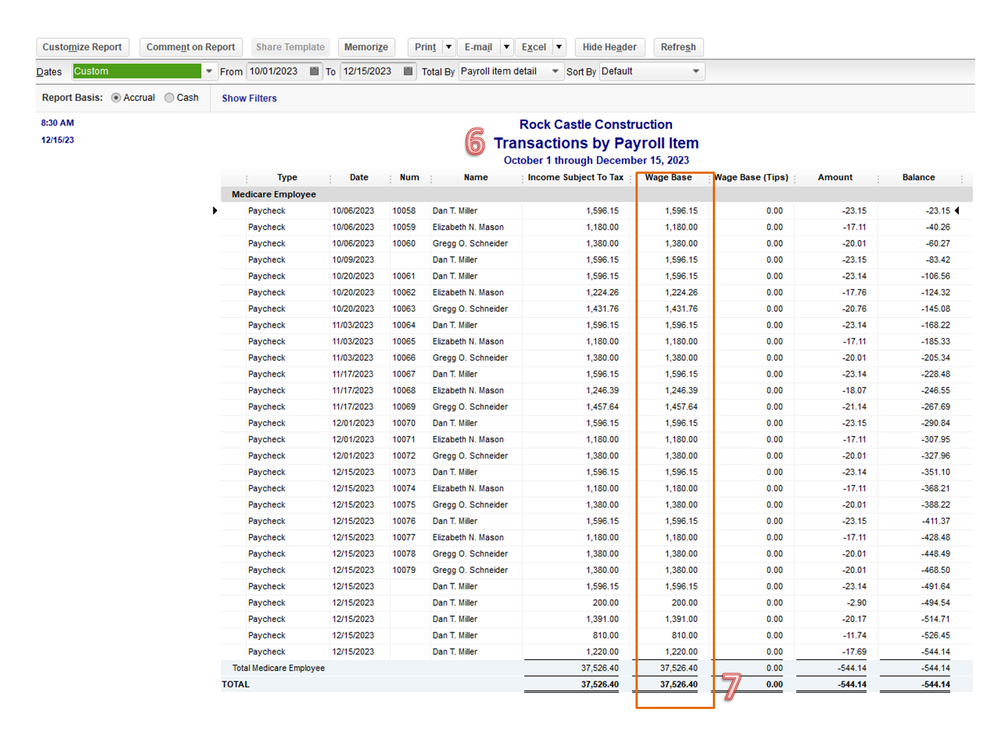

- On the Transactions by Payroll item page, navigate to the Wage Base column and take note of the total amount.

- Then, multiply the Wage Base amount to the tax rate. For example, Social Security (employee and company) or Medicare (employee and company).

- Do this for the remaining payroll taxes.

- Continue performing the steps until you’re able to find $70 underpayment.

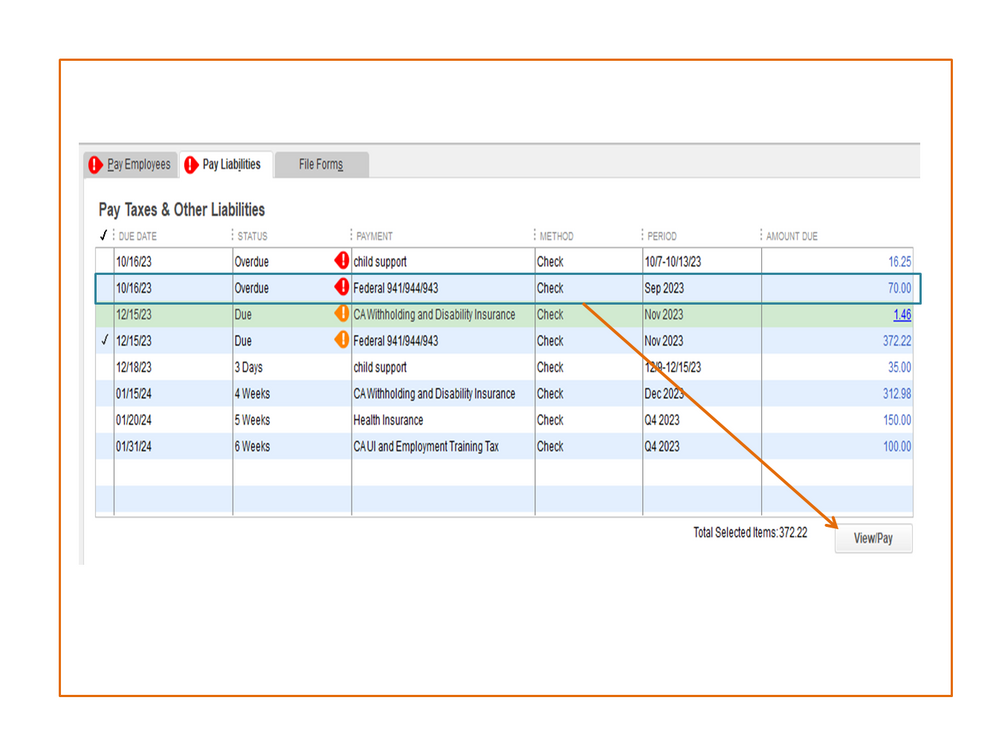

Once you have the information handy, enter a positive liability adjustment to correct the amount. After performing this step, the amount will show in the Pay Taxes & Other Liabilities window. Hover your mouse to the $70 amount and hit the View/Pay button. The payment is recorded to the bank account associated with your payroll.

Here's a guide that contains tips on how to resolve any payroll discrepancies: How to fix common Payroll errors in QuickBooks.

Keep me posted if you need further assistance performing any of these steps. I’m more than happy to help and make sure this is taken care of for you. Have a great day ahead.