Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for using QuickBooks to run your payroll, Karen SCR.

Yes, you can add an employee deduction including contribution and garnishment in the bonus check. On a side note, retirement account deduction like the 401K should be done in a separate bonus check instead of adding it to the regular paycheck.

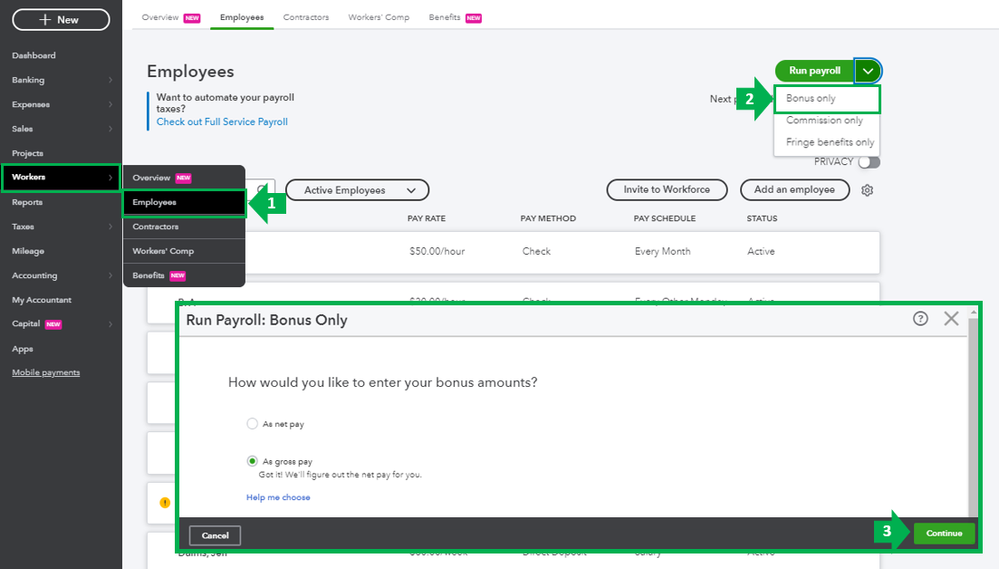

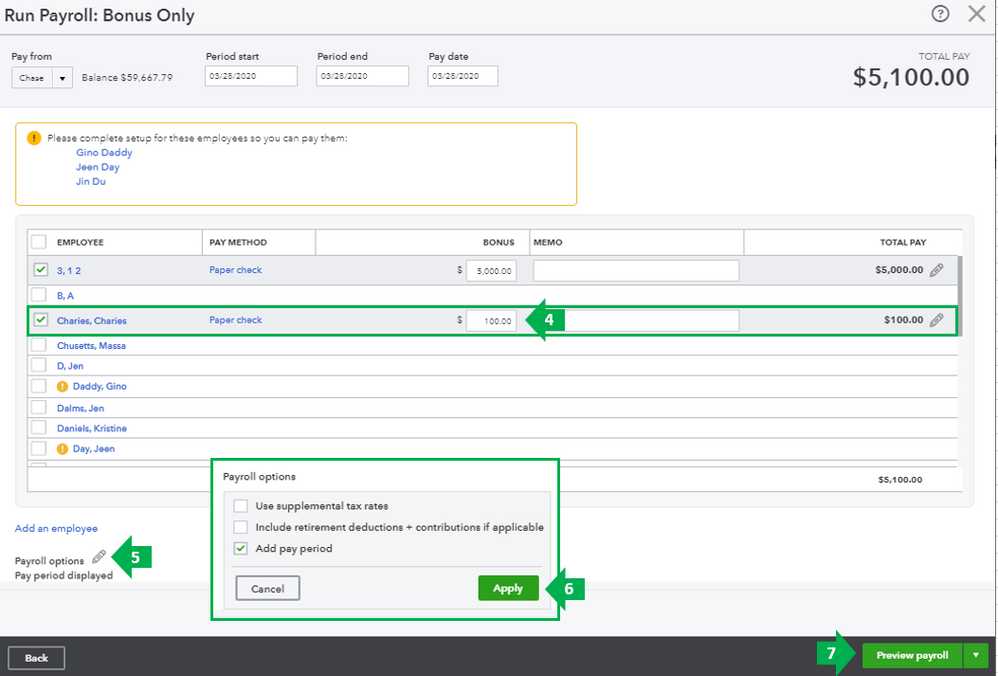

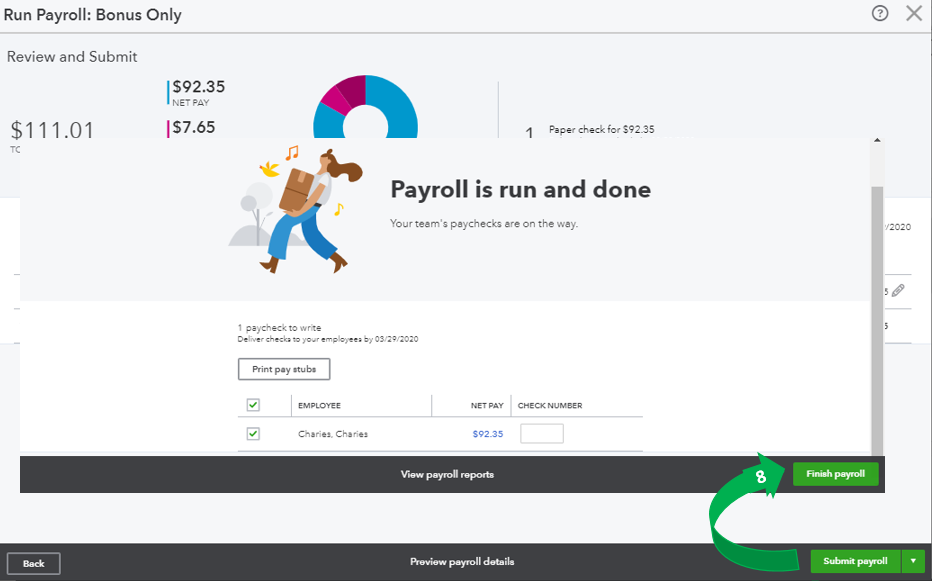

To do this, you can follow the steps below:

I'm adding this guide on how to pay an employee bonus in QuickBooks Online. This also provides the reasons why you need to create a separate bonus check instead of adding it to a paycheck.

It's always my pleasure to assist you. You can count me in if you have other questions. Take care and have a wonderful day ahead!

Quick Books online enhanced payroll DOES NOT give my the option boxes for any of the employee deductions. Your instructions do not work. I can make adjustments to the taxes, but it does not give me ability to make adjustments to the employee deductions (so I cannot take a 401K deduction from a bonus check).

I ended up running the bonus checks as a regular payroll and will make a journal entry to reclassify the salary from officer or bonus officer.

Please give me further assistance (for the future) if there is another way to allow me to make adjustments to the "employee deductions" portion of a bonus check.

Good afternoon, @Karen SCR.

Thank you for clarifying that you're using QuickBooks Online enhanced payroll. Allow me to explain how to do the same steps above for enhanced payroll subscriptions.

1. Select the Payday tab.

2. Under Check Type, hit Bonus Checks.

3. Click Go, then select the applicable settings for the bonus paycheck.

4. Choose the employee and enter the amount.

5. Create then approve the paycheck.

6. If you hit net-to-gross, the pay stub will list Employee Taxes Paid by Employer under the pay section.

This is outlined in the article provided by my colleague above: Pay an employee bonus.

If you still aren't seeing these selections, I recommend reaching out to our payroll support team as they have the tools to pull your account in a secure environment to justify the concern.

Please let me know if you have further questions. I'll be here for you every step of the way. Take care and enjoy your day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here