Hi, Sandy. When running Bonus only payroll, enter the amount As net pay to ensure that deductions are withheld.

Follow these steps to edit and review deductions and taxes before submitting the payroll:

- Go to the left navigation panel and select My Apps, then click the Payroll dropdown. Choose Employees.

- Click the dropdown arrow beside Run Payroll and select Bonus only.

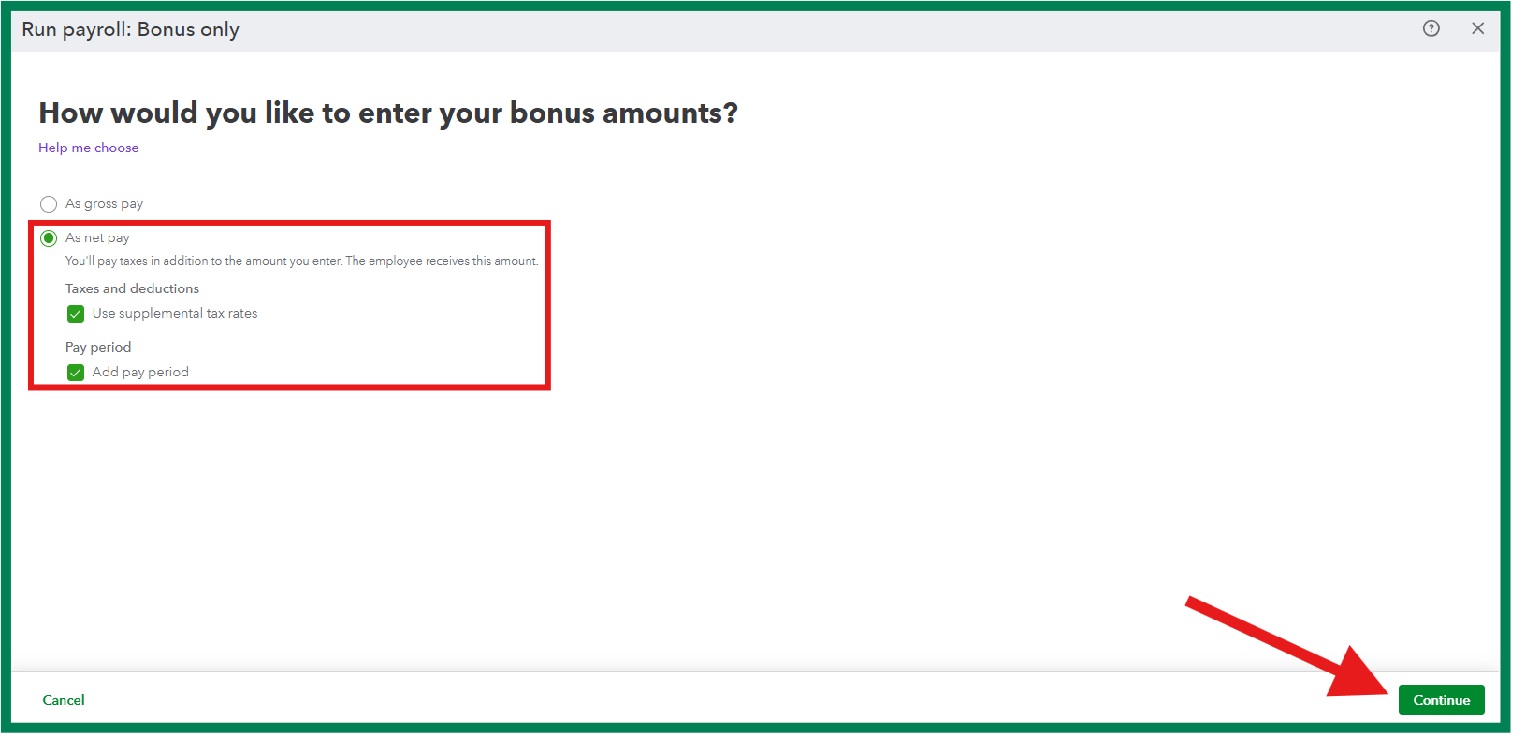

- Enter your bonus amount As net pay. And then click Continue.

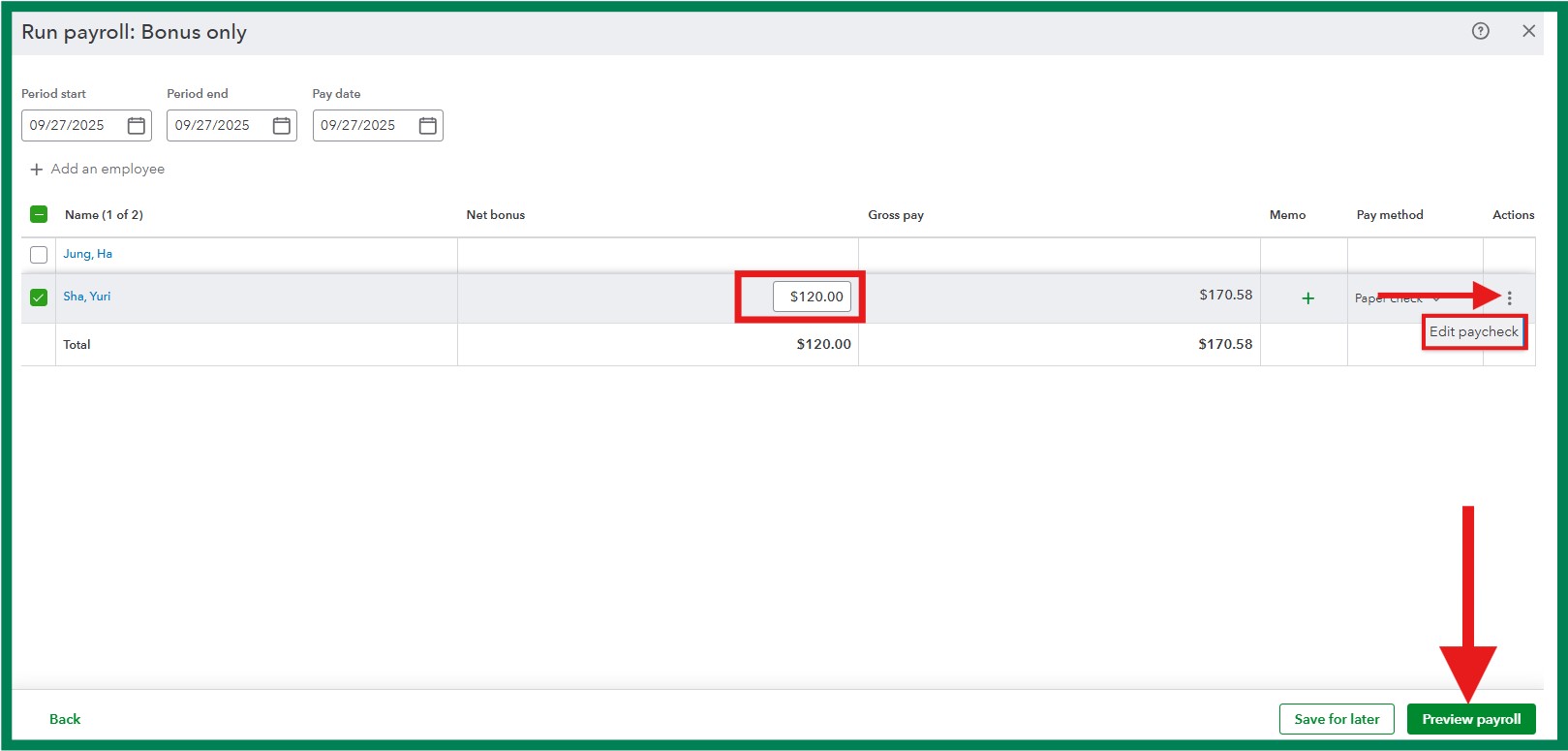

- In the Net Bonus column, input the bonus amount.

- To see the breakdown of deductions and taxes for the specific employee, under the Actions column click ⋮ then, Edit Paycheck.

- When you’re done verifying the details, click Preview Payroll and then Submit Payroll to finish.

If you don't see a specific deduction applied to the bonus, you can check the employee’s profile to ensure the deduction is set up properly. For step-by-step instructions, refer to this article: Set up, change, or delete employee-paid payroll deductions

If you have any further questions or need additional support, feel free to leave a comment on this thread. We’re here to help.