Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen I tried to send Intuit my payroll there was an error that said to try later, when I went back to try to send it I mistakenly clicked start scheduled payroll not realizing it was the NEXT pay period. Now QB wants to send both payroll periods (nothing has been submitted yet). If I just delete the paychecks for the next pay period will QB show that pay period again under create paychecks?

Solved! Go to Solution.

Yes, you can delete the paychecks, but QuickBooks will not automatically display the current pay period. To fix this, you will need to edit the incorrectly created payroll schedule and update it to the current pay period, DD119.

Here's how you can delete the paychecks:

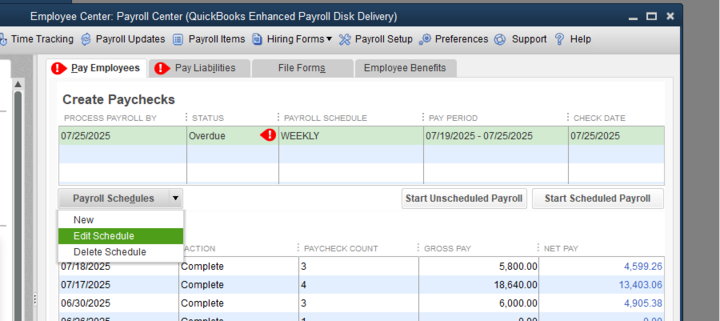

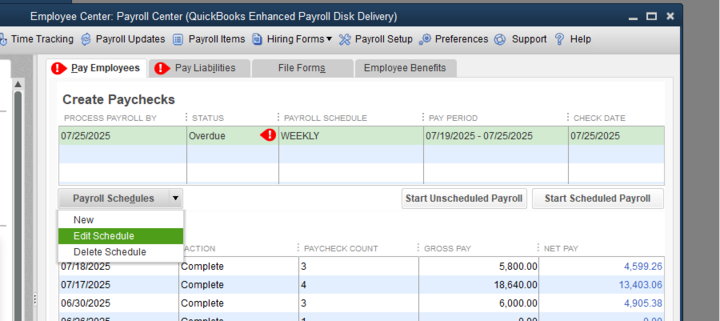

After deleting the paychecks, navigate to the "Pay Employees" window. Highlight the incorrect payroll schedule, click on the Payroll Schedule dropdown, choose Edit Schedule, and update it to the current pay period. Here's a sample screenshot:

Please resend your payroll. If the error persists, I recommend contacting our Live Support team for assistance. They have the tools and expertise to investigate and resolve this type of issue in a secure environment.

Please leave us a response if you have other questions or concerns.

Yes, you can delete the paychecks, but QuickBooks will not automatically display the current pay period. To fix this, you will need to edit the incorrectly created payroll schedule and update it to the current pay period, DD119.

Here's how you can delete the paychecks:

After deleting the paychecks, navigate to the "Pay Employees" window. Highlight the incorrect payroll schedule, click on the Payroll Schedule dropdown, choose Edit Schedule, and update it to the current pay period. Here's a sample screenshot:

Please resend your payroll. If the error persists, I recommend contacting our Live Support team for assistance. They have the tools and expertise to investigate and resolve this type of issue in a secure environment.

Please leave us a response if you have other questions or concerns.

That worked. Thank you!

You're always welcome, DD119.

I’m glad that my colleague’s assistance helped with your payroll concerns. We admire your dedication and patience in following the guidance provided.

Reply here or create a new forum if you have questions about QuickBooks. We're always here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here