Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'll help you resolve the issue of not being able to run payroll in QuickBooks Online, @info1511.

Before we proceed, could you please provide any specific error messages you're seeing? The exact error message will greatly help us in identifying the issue and providing a more effective resolution.

In the meantime, we can perform the browser troubleshooting steps to fix the issue.

Your cache stores files from websites you visit to speed up loading times. However, if it holds too much data, it can slow down browsing speeds on sites like QBO.

Consider a full cache as a potential cause of issues. Thus, trying other browsers may resolve the issue since it doesn't store your data.

If the steps above will not work, you can use supported browsers as an alternative. Otherwise, I recommend clearing your browser cache to prevent using outdated forms, protect your data, and enhance program performance on your computer.

Experience the advantage of same-day deposits by exploring QuickBooks Payroll. This way, you can pay your employees quickly ensuring funds are available in their accounts on the same day the payroll is processed.

For additional reference, visit this link to learn about running payroll reports in QuickBooks Online.

Let me know if you have additional questions about running payroll in QuickBooks Online by commenting below. I'm always here to help. Have a great day.

I am not getting error messages. I entered payroll information this morning but did not have my PIN/passwords to submit payroll to Intuit. Now several hours later I am trying to go back and submit payroll but cannot locate how to do it?

I know how important it is to get payroll submitted on time, and you’re in the right place, @r62664. Let me share some information that can help you with this matter.

Before we proceed, please note that in QuickBooks Online Payroll, once the payroll is processed, it will be sent automatically to Intuit, so there is no need for a PIN or password.

However, if you're using QuickBooks Desktop Payroll, after you create or schedule paychecks in your Desktop company file, you must authenticate with your payroll e‑services PIN.

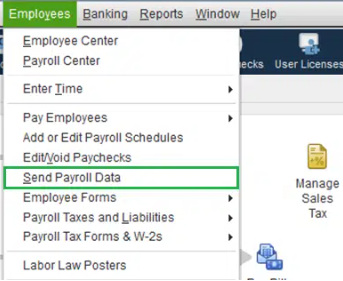

To submit payroll to Intuit, you can follow these steps:

If you see a message, “QuickBooks can’t find the following account”, try these steps:

Regarding your concern with PIN or password, if you meant you forgot the password and you want to change it, you are free to check this article: Change direct deposit PIN in QuickBooks Desktop Payroll.

If you meant something else, please reply to this thread and tell us more. We want to make sure I address exactly what you need. Thank you for your patience and for sharing your concern with us. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here