Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We were notified that ACH Debit payments will no long be accepted by the State of Coloardo Department of Revenue. We have several clients that use quickbooks desktop and the tax payments are set up for ACH Debit. It looks like our only option is to have our clients sign up for an account through the department of revenue and give us access to their accounts so we can make the payment that way. Does anyone know a work around on this

I'd be glad to share some information with you about ACH payments in QuickBooks Desktop (QBDT), LJ79Whatwhat.

In QuickBooks Desktop (QBDT), there are different filing and payment methods depending on your state tax.

In the State of Colorado Department of Revenue, your clients are responsible for paying their taxes to the agency. Since your state is no longer accepting ACH debit payments.

To record these payroll taxes that were paid to the state, we'll need to pay your scheduled liabilities in QBDT. Here's how:

I have collected a few articles that provide instructions about entering previous payroll data and adjusting payroll liabilities. Each link offers guidance on how to transfer accurate data from QuickBooks to Excel.

Please don't hesitate to reach out if you have any further questions or concerns regarding payroll and any other topic related to QuickBooks. Take care and stay safe.

Does Quickbooks have any plans to make e-payments available in Colorado using another method?

Hello there,

Welcome aboard to the Community space. Allow me to chime in and share some information about paying Colorado payroll taxes.

The options for paying state payroll taxes and filing forms will depend on your state. Since ACH Debit payment option through Revenue Online will not be available to make payments after 4 p.m. June 29, 2023, we'll share an update soon.

Most tax types payable on PayConnextion are available in Revenue Online (ROL) when signed into your ROL account. For now, you can visit your state agency website for updates or check out our articles about state e-file and e-pay through these links:

Also, you can monitor the status of your payroll tax forms and payments submitted through the Desktop Payroll Enhanced version. I've included a link you can check out to learn about the steps to find a form or view statuses in QuickBooks: Check e-file or e-pay status.

Comment below if you have additional questions about making tax payments in QuickBooks. We're always ready to help. Take care always.

What is the status of Quickbooks updating the payment methods that are available to pay to Colorado? I don't feel like I should be paying for QB Payroll if I can't even pay my liability taxes through that system. Colorado made it know more than a month ago that this change was happening, why hasn't Quickbooks come up with a solution?

I recognize the significance of fulfilling liability tax payments within QuickBooks Desktop (QBDT), kristi720.

In QuickBooks Desktop, the payment method used for Colorado to pay taxes and liabilities depends on the specific options available within the software. Since ACH payments have been replaced, it would be best to consult the latest documentation or official resources from the Colorado Department of Revenue to determine the currently supported payment methods for tax and liability payments in Colorado. These sources will provide accurate and up-to-date information on the available payment options within QuickBooks Desktop.

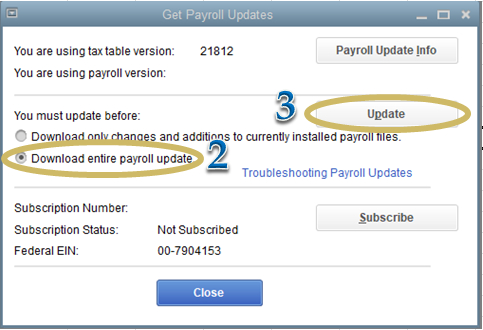

Meanwhile, let's update QuickBooks to its most recent release to keep it up-to-date so you have the latest features and product improvements. I'll provide you with instructions on how to accomplish this task.

Right after, run a payroll update to refresh your payroll settings. Let me show you how:

To check the latest tax table, please click this article: Latest Payroll News and Updates.

Keep me updated on how this goes. I’m always here to help if you need further assistance. Have a good one!

This is not a relevant answer...

We are aware of how to file with the CO Department of Revenue. What everyone is asking is does Quickbooks have a plan to fix this so we can once again file and pay Colorado payroll taxes in QB??

I understand how important paying your payroll taxes is, @Bakemeawayco. Let me share an update about it.

The options for paying state payroll taxes and filing forms will depend on your state.

Since ACH payments are no longer accepted, it is best to go to the most recent documentation or official resources from the Colorado Department of Revenue to learn about the accepted payment options for Colorado tax and responsibility payments. These sources will offer precise and recent information on the QuickBooks Desktop payment choices that are readily available.

I've included a link you can check out to learn about the steps to find a form or view statuses in QuickBooks: Check e-file or e-pay status.

For future reference, you can check this article about state e-file and e-pay through these links:

Comment below if you have additional questions about making tax payments in QuickBooks. We're always ready to help. Take care always.

The Colorado Department of Revenue site does not "offer precise and recent information on the QuickBooks Desktop payment choices". site. There is no reference whatsoever to QuickBooks. That is why we are asking QuickBooks if you re going to provide the capability to e-pay Colorado payroll taxes. Please answer this question.

I have spoken to a representative at the Colorado DOR and they have no clue how to set up payment through Quickbooks. Their process to add a "third party processor" is really just creating another user id on their ROL so someone else can sign in and pay. Very disappointing that Quickbooks has not addressed this in their software updates.

I can say the same thing about the Colorado FAMLI deductions that started January 1st. I set up the deductions and the rate, but still have to manually input the rate on each employee's record.

There should be a way to pay them through Quickbooks too on the Enhanced Payroll Subscription.

Thank you for reaching out to Community, @crystallemmons1310.

I appreciate your effort in communicating with a representative at the Colorado DOR. It's convenient indeed to have the rate automatically set up on an employee's record in the program.

To ensure accurate amounts, it's important to manually enter the different rates and deductions for each employee into the program. Unfortunately, this feature is not currently available. I suggest sharing this idea with our Product Developers so that it can be considered for future updates.

Here’s how:

You can track your suggestion through this website. You can also visit our blog to keep up with recent events and developments.

To learn more about accessing your state agency websites and paying state payroll taxes, refer to these articles:

If you need to view the standing of your payroll tax forms and payments submitted: Check e-file or e-pay status.

Please know that we cannot provide a timeline for its implementation. For other questions about taxes, add them to this thread. We're here to help you. Stay safe.

I'm not sure why this would be a 'Product Suggestion'....

It is an existing feature that no longer works. Why would we need to suggest that you fix it??

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here