Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI check the box to the left, the box turns green with a white check mark. This eliminates the employee from the payroll run. In my experience, there is a note at the top when you review payroll letting you know to check the box for an employee without hours.

Good day, @greyfoxfeltingte. I'm here to help.

You don't need to run payroll if your employee didn't work in a pay period. Since no employee wages are recorded, you don't have taxes to report for the employee.

When processing payroll, you can exclude the employee who has not rendered hours. Here's how:

Also, I'm adding this article about the available reports in QuickBooks Online (QBO) that you can use to verify your payroll information before filing taxes: Run payroll reports.

You're always welcome in the Community should you have further concerns about running payroll in QBO. Take care.

My situation is I have (1) employee on bi-weekly payroll. I can't uncheck (1) employee...it won't work. Will QB's continue to remind me that payroll is due for the (1)? Is there a way to resolve this?

Thank you for joining and sharing those details in this thread, Lashaefer.

I'll provide some information about the pay schedules and how they work in QuickBooks Online Payroll.

Before we start, may I ask if you are attempting to uncheck and exclude an employee from your current payroll process? I'd appreciate it if you could attach a screenshot of the page where you attempted to uncheck the employee.

In the meantime, let us make sure your employee is set up for a Bi-weekly pay schedule. To do so, you can follow the steps below:

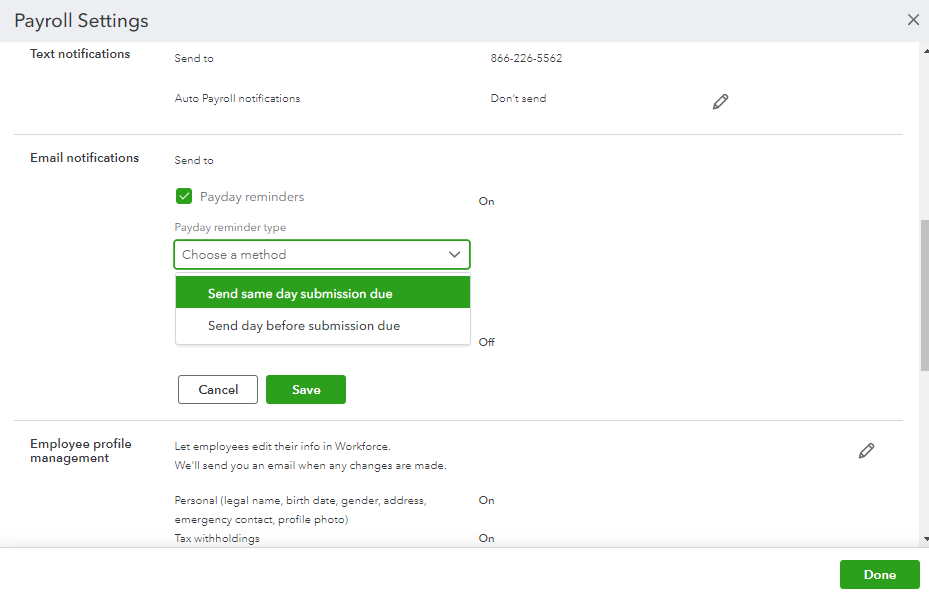

Regarding the payroll reminder, if you're processing payroll through direct deposit, QuickBooks will normally send you an email notification two days before the payroll submission. You can also set up and choose a specific payday reminder in your payroll settings.

Here's how:

To learn more about managing pay schedules, see this link: Set up and manage payroll schedules

I've also added this article as a future reference: Invite your employees to QuickBooks Workforce to see pay stubs, W-2s and more if you use QuickBooks ....

Let me know if you still have other payroll-related concerns and questions. I'd be happy to help. Have a great week!

Thank you, Archie. I appreciate the reply. I found that I just needed to advance the payroll date for that bi-weekly employee to the next p/r run.

Thank you for taking the time to post here in Community space, @Lashaefer.

I'm glad to hear that the instructions provided by my colleague have helped you with your pay schedule. Here in the Community forum, we always ensure to address and provide accurate solutions to every customer's concern.

Let me know if you have additional concerns, and I'll get back to you as soon as I can. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here