Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am using QB Premier desktop with manual payroll. We use our local bank's payroll service to transfer the money via EFT. An employee received a raise and I changed the employee's annual earnings amount in the employee's profile. However, when I do the accounting for payroll, the amount in the paycheck detail remains the same old, lower amount. Note: I changed the earnings amount and am doing the accounting after the date of the payroll.

Hi there, @WebeRE.

I'm here to make sure we've got everything configured. This way, you have an accurate payroll records.

A part of your QuickBooks Desktop data may have been damaged. This causes the program not to recognize the updated annual earnings properly. I recommend running the Verify and Rebuild Data tool. Verifying will detect any damaged data, while rebuilding will attempt to fix it. It also allows your QuickBooks software to refresh the data inside the company file.

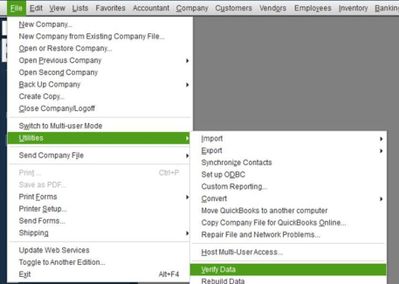

Follow the steps below on how to verify data:

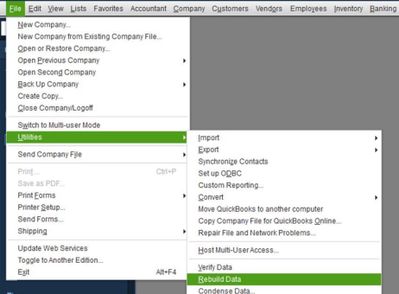

Next, here's how to rebuild data:

Then, if you've already saved the paycheck, you'll want to delete and recreate it. Make sure it has the updated information. If it still has the same old rate, update the program to its latest release version to get the newest features and fixes.

Here's how:

I also suggest turning on the automatic update feature to make sure that your QuickBooks Desktop is always updated. Please check this article and follow the Schedule future automatic updates steps: Update QBDT.

Please give it a go. If you hit any issues while running payroll, feel free to comment here. The Community will always have your back!

I tried this but ...no luck. Is the problem caused by the fact that I changed his earnings in November but the payroll date is October 15th and QB can't can't make the change retroactively? As I said before, we don't use QB payroll so I usually am doing the accounting after the pay date.

Hi there, @WebeRE. I'm here to ensure you'll be able to raise your employee earnings in QuickBooks Desktop (QBDT).

Thanks for getting back here and for sharing the outcome of the steps you've performed. I can see that you did everything you could. To help you resolve this, you'll also need to manually update the rate on the employee paycheck. Since you're not using the Payroll service, you'll have to set up the payroll in QBDT manually.

For reference, feel free to check this article: Set up manual payroll without a subscription in QuickBooks Desktop.

Also, running employee reports to keep track of their important detail is a breeze in QBDT. To get started, please visit this page for detailed info: Customize payroll and employee reports.

Keep me posted if you have any other concerns about updating the paycheck of your employee. I'm just a post away to lend a hand. Have a good one.

Thanks to both of you for replying, but again...no luck. I checked the settings for manual payroll and they are correct, although I didn't see a "Get payday piece of mind" window that you mentioned. We've been using manual payroll for several years and this is the first time I've encountered this situation. It's as though the earnings information for that employee is locked. I am wondering if I could add another category of earnings somehow for the raise so that the total would be correct -- at least until this issue is resolved.

Thanks for getting back for some updates, @WebeRE.

I appreciate you for following the steps provided by my colleague which is to manually update the rate on the employee paycheck.

Since all of the possible steps didn't work. I agree with you in creating another category of earnings for the raise.

To start, let's set up the item first. Here's how:

For reference, feel free to check this article: Add or change pay types

Once you're all set, you'll want to utilize this reference whenever you're ready to run your payroll: Create and run your payroll.

If you have any further questions about managing your payroll in QBDT, you can always count on me to assist you. Keep safe, and have a good one!

Thank you, AbegailS. Your solution worked for the pay period that I was having trouble with, so that is solved. I also began another payroll just to see what would happen with the employee in question, and voila! the correct amount is in there, without the added earnings item. My guess as to what happened is this (it's a guess because I don't remember all the details): I began to process a payroll, than realized after I started that one employee had received a raise. QB wouldn't let me change the amount because I had already started the process and it kept reverting back to the earlier amount when I tried to change the earnings amount. (Note:it would be nice to be able to change the amount even after starting to process the payroll). SO, everything seems to be working correctly. Thanks for your help.

Hi there, @WebeRE,

I'm glad to hear that my colleague AbegailS was able to help you! Should you need anything else, please don't hesitate to post here.

Please know that you're always welcome here in the Community. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here