Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @cmingle.

Changing the setup of your simple 401k to simple 401k catch-up needs assistance with our Customer Support Team. They can do payroll correction in case you have existing paychecks of your employee that need to change.

Simple 401k catch-up contributions will normally apply to those employees who are age 50 or over at the end of the calendar year and this will apply for future paychecks.

Here's how:

To ensure we're able to address your concern on time. You may refer to our business hours (Monday to Friday, from 6:00 AM to 6:00 PM PST and Saturdays from 6:00 AM to 3:00 PM PST.

I'm adding these articles that will guide you with retirement contributions in QuickBooks:

Please know that you're always welcome to comment below if you have other concerns or follow-up inquiries about managing your contributions in QBO. I'm just around to help. Take care always.

Thanks for following up with us, @cmingle.

I'm happy to provide some additional steps included with some screenshots, along with a link to chat with our QuickBooks Online Payroll support.

Let's get started.

That's all there is to it. You can use the link below to chat with our Payroll support below.

Please let me know if there is anything else that I can do for you. I'll be here every step of the way. Feel free to reach out to the Community at any time. Have a wonderful weekend!

I'm being told they can't help. Do I just need to call back at a different time of day? Is there anything I can do myself? I could cancel the regular 401k and remake it as a "catchup" but then I have to manually keep track of the maximum contributions, and I'd rather Intuit take care of that...

You're already on the right track in changing the setup of your employee deduction/contribution from simple 401(k) to simple 401(k) catchup, @bobhope. Let me share further details about this and guide you on the actions you need to complete the process.

Each retirement plan has an annual limit. The 401(k) is used for employees under 50, while the 401(k) Catchup is used for employees 50 years of age and over (includes employees turning 50 in the same calendar year).

To keep your employee account updated, you need to remove the regular 401(k) plan and change it with the 401(k) Catchup. This way, QuickBooks will automatically update and make the necessary adjustments.

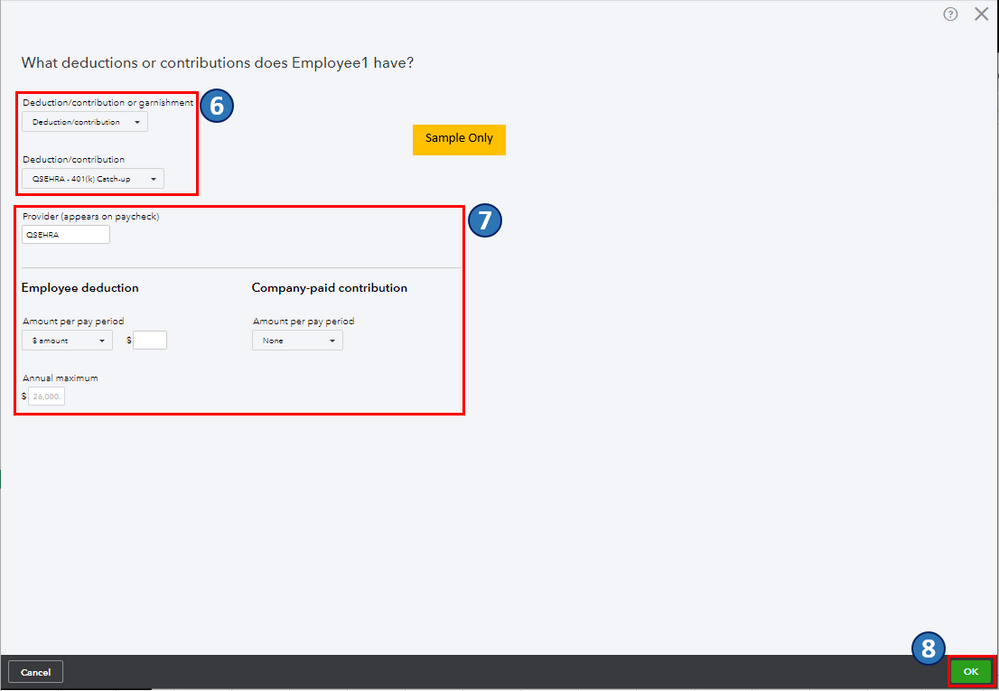

You'll first need to add the 401(k) catchup retirement plan deduction and company contribution in QBO. Then, follow these steps to assign it to your employee:

Once you process payroll for the employee, the 401K catchup deduction will automatically be deducted from their paycheck.

Also, I'm adding these articles to learn more about retirement plans and available pay types in QBO:

Keep me posted on how it goes. If you have other payroll concerns or inquiries about updating retirement plan deduction in QBO, you can drop a comment below. I'm just around to help. Take care, and wishing you continues success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here