Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQuickBooks is showing me an alert that my Federal 940 is overdue. I only owe $42 at this time. My understanding is that I don't need to pay that until the end of the year or until my liability is greater than $500. How do I get rid of this alert?

Solved! Go to Solution.

You're right, @FCN1.

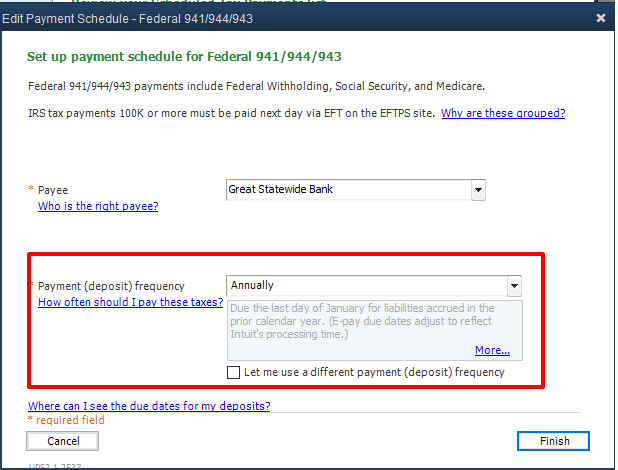

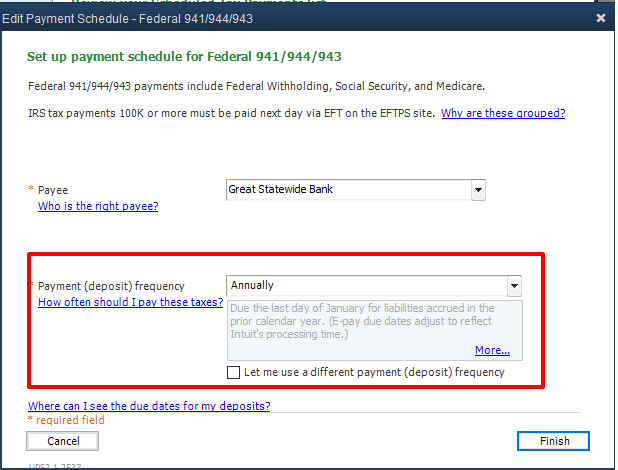

The Federal 940 is annual tax payment. There's a chance the 940 is not scheduled to yearly, thus, you received the overdue alert. Let's ensure the 940 pay schedule is set to Annually. Let me guide you on how to check it in your QuickBooks Desktop (QBDT).

Here's how:

However, if the payment frequency is already set to annual, it could be the liabilities were paid but were not recorded in your QBDT. Here's an article you can read for additional reference. This link provides detailed information on why scheduled liabilities show overdue: Scheduled liabilities payroll show as overdue or in red.

I also got you this article for reference in case you need to remove a scheduled payroll liability: Remove or delete a scheduled payroll liability.

Know that I'm always here to help you in case you have other concerns or questions in the future. Keep safe and stay healthy!

You're right, @FCN1.

The Federal 940 is annual tax payment. There's a chance the 940 is not scheduled to yearly, thus, you received the overdue alert. Let's ensure the 940 pay schedule is set to Annually. Let me guide you on how to check it in your QuickBooks Desktop (QBDT).

Here's how:

However, if the payment frequency is already set to annual, it could be the liabilities were paid but were not recorded in your QBDT. Here's an article you can read for additional reference. This link provides detailed information on why scheduled liabilities show overdue: Scheduled liabilities payroll show as overdue or in red.

I also got you this article for reference in case you need to remove a scheduled payroll liability: Remove or delete a scheduled payroll liability.

Know that I'm always here to help you in case you have other concerns or questions in the future. Keep safe and stay healthy!

Thank you! I couldn't figure out where to look to change the payment frequency. It was set to quarterly. Got it corrected, and all looks good.

Yes, it was set quarterly. I got it changed and all looks good. Thanks for your help.

Omg! Thank you so very much!

I'm glad the steps shared by my peer above helped resolved your 940 form concerns, @carrieescsteel.

Come and visit us if you have any further questions. I'll be glad to assist you soon.

How do I do this, but on Quickbooks Online?

We're glad to see you here in the thread, @jr1452.

Before we proceed, if you've already paid your due outside QuickBooks, know that you'll need to have it recorded inside your QuickBooks Online (QBO) Account to get rid of the notification. We'll gladly write down the steps to get you going:

See this article for more details: Record prior tax payments.

In addition, you can also check these pages to learn more about automatic tax payments, keeping your data accurate, and the year-end checklist for QBO Payroll:

@jr1452, The Community space is open 24/7 if you need assistance managing tax notifications inside QuickBooks. We can also help you again if you have tasks you want to perform inside the program. Feel free to drop by anytime. Rest assured, we're here. Ready to assist you. Stay safe, and have a nice day!

Did you receive a correct answer for your question? I have the same issue. The person that replied did not provide the proper response. Thank you !

This is not the correct answer to the question. QBO is showing 940 tax payment due monthly instead of annually. How can this frequency be changed in QBO?

Hi there, @kflynn0270.

Allow me to chime in and provide information about tax payment and frequency in QuickBooks Online Payroll.

In QuickBooks Online, the frequency will vary depending on the state you are in. You can check this article that state withholding website for more details. For now, I suggest contacting the IRS to determine what specific frequency that is applicable in your state or location. You can go through this link to reach out to them: Contact IRS.

Feel free to check out these articles for more guidance about tax form filing frequency and tax payment frequency:

Please let me know by commenting below if you have any other concerns with managing your frequency or other concerns about Form 940. I'm always here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here