Closing your business is a significant decision, and I want to acknowledge the hard work and dedication it has taken to reach this point. I'm here to ensure the process of winding down operations is as smooth and stress-free as possible for you, rbaines.

Currently, there's no option to mark checkbox D on the 940 forms directly within our system. However, you can print out the form and manually mark the checkbox as needed. Once you have completed this step, please ensure you file the form with the IRS according to their guidelines. For further clarification and detailed instructions, you can refer to the IRS article Final: Business Closed or Stopped Paying Wages.

If your subscription is still active, you have the option to cancel it after you have filed and settled all your tax obligations. This proactive step will help prevent any unwanted charges from accruing in the future.

Here's how:

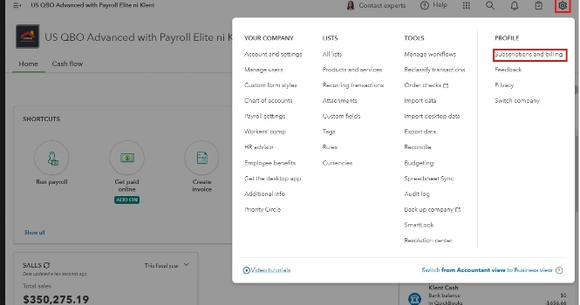

1. Navigate to the Gear icon, then proceed to Subscriptions and billing.

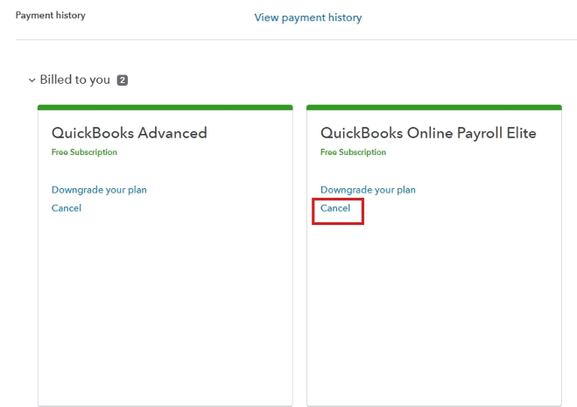

2. Locate the product you want to cancel and click Cancel.

3. You will encounter a survey asking for the reason behind your subscription cancellation. After completing it, click on Continue to cancel.

4. Next, a page will display the benefits of the product and the final day your subscription will be active. Tap on Continue to cancel.

5. Finally, a pop-up will appear confirming that your subscription has been canceled. Hit on Got it.

Additionally, it is crucial to download and save copies of all your forms, reports, transaction lists, and any other relevant documents. Please note that after one year, our system will automatically erase your data. Having these records will be invaluable, particularly in the event of an audit. This ensures you have a reference for any questions about your filings.

Even if you are no longer handling payroll, these articles might assist you with completing year-end tasks for the current calendar year:

Thank you for using our services, rbaines. If you have any more questions or need further assistance as you finalize your business affairs, please don't hesitate to reach out. Remember, you're not alone in this process. We’re here to guide you every step of the way. Take care and I wish you the best in your future endeavors.