Thank you for reaching out with your question on how to write a bonus check in QuickBooks Online (QBO) so the net amount received by the employee matches the intended bonus value. I'll walk you through the steps on how to configure this properly in QBO.

Here's how you can run a bonus paycheck:

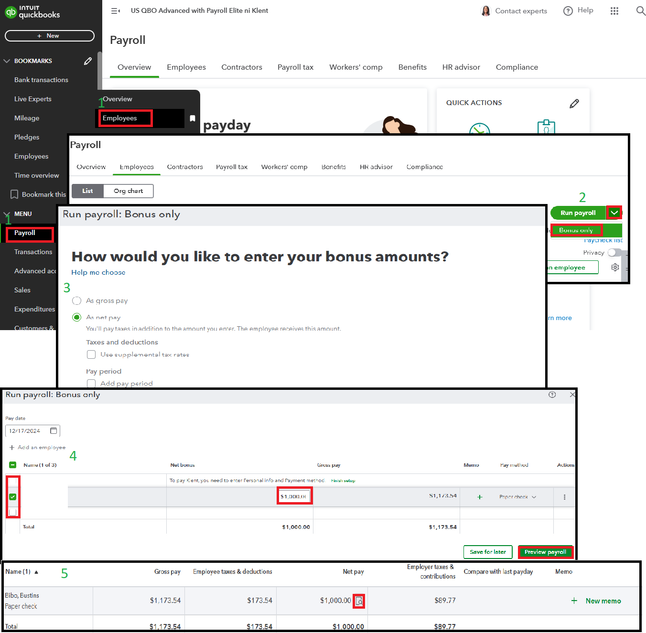

- Navigate to Payroll, then Employees.

- From the Run payroll dropdown, click Bonus only.

- Choose how you'd like to enter the bonus:

- As a net: The employee receives the exact bonus amount. Taxes are calculated, but you will cover them.

- As a gross: We’ll calculate the net amount for you.

- Select the employee, then enter the Bonus amount and click on Preview Payroll.

- Use the magnifying glass icon to review and ensure everything is correct, then click Save.

- Once you've verified the details, click Submit Payroll.

Please know that if you’ve selected As net pay, the pay stub includes Employee Taxes Paid by the Employer in the pay section.

For more information, you can check this article: Pay employee bonuses.

Additionally, for a more detailed view of your business finances and information on your employees, you can access the following material: Run Payroll Reports.

The steps provided adjust for taxes and deductions to make sure the net pay matches the intended bonus amount, ensuring your employee receives the exact bonus you intend. If you have follow-up questions, you can always revisit this page.