Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe're unable to add more than two garnishments, kwade.

In QuickBooks Online (QBO), you can only add two garnishments per employee. You can visit this article for more details about this process: Set up and collect garnishments.

While this option is unavailable, I do think this would be a great time to send this suggestion to our Product Development Team to help improve your experience. They can review your suggestions and might make some adjustments in the next update.

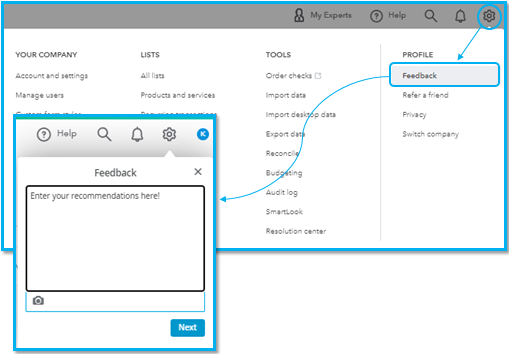

Here's how:

Additionally, you can pull up a variety of payroll reports in QuickBooks. This will give you a closer look at your employee's total wages, deductions, and tax information in a certain period. For the complete list of available payroll reports and how to pull them up, kindly refer to this article: Run payroll reports.

Please don't hesitate to reach back out if you need assistance with anything else about QuickBooks. Have a wonderful day!

So how would I track a third garnishment if only two are allowed in QuickBooks Online?

I acknowledge the importance of correctly setting up all payroll garnishments, @acctng2023.

To track the third one, follow these steps:

Additionally, you can use this article to learn more about setting up benefits or deductions: Employee-paid payroll deductions.

Let us know in the comments if you have any other concerns regarding payroll, taxes, and forms. It's our priority to ensure your success.

I have the same issue. One employee has 3 garnishments. This is a major stumbling block in QBO's part. I ended up doing what was suggested, by adding another "wage garnishment", but I have no idea if it's the same.

Very troubling indeed.

I'm the same situation. Does QBO adjust the percentages if garnishments exceed the 50% federal guideline of net payroll?

Hello there, @topsecretbk.

Let me share information if QuickBooks will adjust automatically based on the Federal guidelines for garnishments.

No, QuickBooks Online (QBO) does not automatically adjust garnishment percentages if they exceed the 50% federal guideline of net payroll. It's important to manually adjust the garnishment amounts to ensure compliance with federal guidelines.

To add a third garnishment, follow the steps provided by my colleague above, LieraMarie_A.

Here are some resources you can check to learn more about garnishments:

Feel free to comment below if you have questions about employee garnishments in QuickBooks Online. I'm always here to help. Have a great day.

This needs to be addressed/fixed. It should be such a simple thing that will keep people from over garnishing accidentaly since there is no % limit on the regular deduction page

For what reason is this not an option? Is there an update on when this feature will be added?

Hello, @ballardwater.

To ensure accurate payroll processing in QuickBooks Online (QBO), please note that the system allows for a maximum of two garnishments per employee.

I understand that the option you're looking for is currently unavailable. However, I believe this is a good opportunity to forward your suggestion to our Product Development Team to enhance your experience. They can review your feedback and may consider making adjustments to the next update.

Here's how:

Additionally, in QuickBooks, you can access a range of payroll reports to get detailed information on your employees' wages, deductions, and taxes for a specific period. To find out the complete list of available payroll reports and learn how to access them, please refer to this article.: Run payroll reports.

If you have further questions about your garnishments, you can comment below and we'll respond to you as soon as possible.

Feedback has been left multiple times and a year later after this post, still no improvement.

4-1-2024 I'm having this same issue. How many customers must have this issue before it is addressed? This is a massive failure. Please take care of this, sooner rather than later. Actually, it's already later.

HELLO?????

I greatly value your feedback and understand that having the ability to add more garnishments. This process is crucial for us to improve our products and services.

I appreciate your understanding that the unavailability of features can sometimes be a part of any product, and we strive to address them to the best of our ability.

As we value your ideas, I recommend sending your feedback to our Product Development Team. Here's how:

Also, feel free to visit our Feedback forum page to see a list of other QuickBooks users who have already suggested this feature and for the recent updates in QuickBooks.

In the meantime, I recommend using a third-party app to help you with this. You can manage your third-party app connections in the My Apps tab in your QBO account.

You can utilize this article for future reference: Customize reports in QuickBooks Online.

For additional QuickBooks-related concerns, don't hesitate to post them here in the Community. We're always available and willing to lend a hand to your queries. Have a great day ahead.

Apparently you do not value our feedback since this issue has been reported multiple times with no resolution.

Your suggestions are pretty useless. They really just make us more angry because they clearly don't solve the problem.

Is this the same for quickbooks desktop? Does it calculate the 50% max on quickbooks desktop?

Yes, Bhovis, QuickBooks Desktop (QBDT) calculate the 50% maximum on garnishments. However, the specific amounts that can be withheld from an employee's paycheck may vary based on certain factors. I'll provide a more detailed explanation on this topic.

QuickBooks Desktop includes a feature to handle payroll garnishments. However, it doesn't automatically calculate the maximum allowable garnishment limit. Thus, it's required to manually enter the garnishment percentage when setting up the payroll item for a garnishment.

You can refer to this screenshot:

Keep in mind that to properly manage these garnishments, it is recommended to determine the garnishment percentage based on legal advice and then manually set up a deduction payroll item.

Moreover, to help manage your other company deductions and employee’s retirement/health insurance plan, check out these articles:

I'm still ready to back you up if you need more help with payroll. I'll keep the thread open so you can comment back.

There is no point in forwarding anything to your project development team because they offer no resolution. You would think that in this day and age there would be an option for more than 2 garnishments. The desktop version offered it and I know this because I used it. It is ridiculous that your software cannot perform basic duties of payroll operations, this is just one of the many issues that I have incurred from your subpar programming. Get with the program and fix it, it has been years (as in multiple) since this topic was brought up and you still offer no solution.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here