Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowSolved! Go to Solution.

Hey Ann,

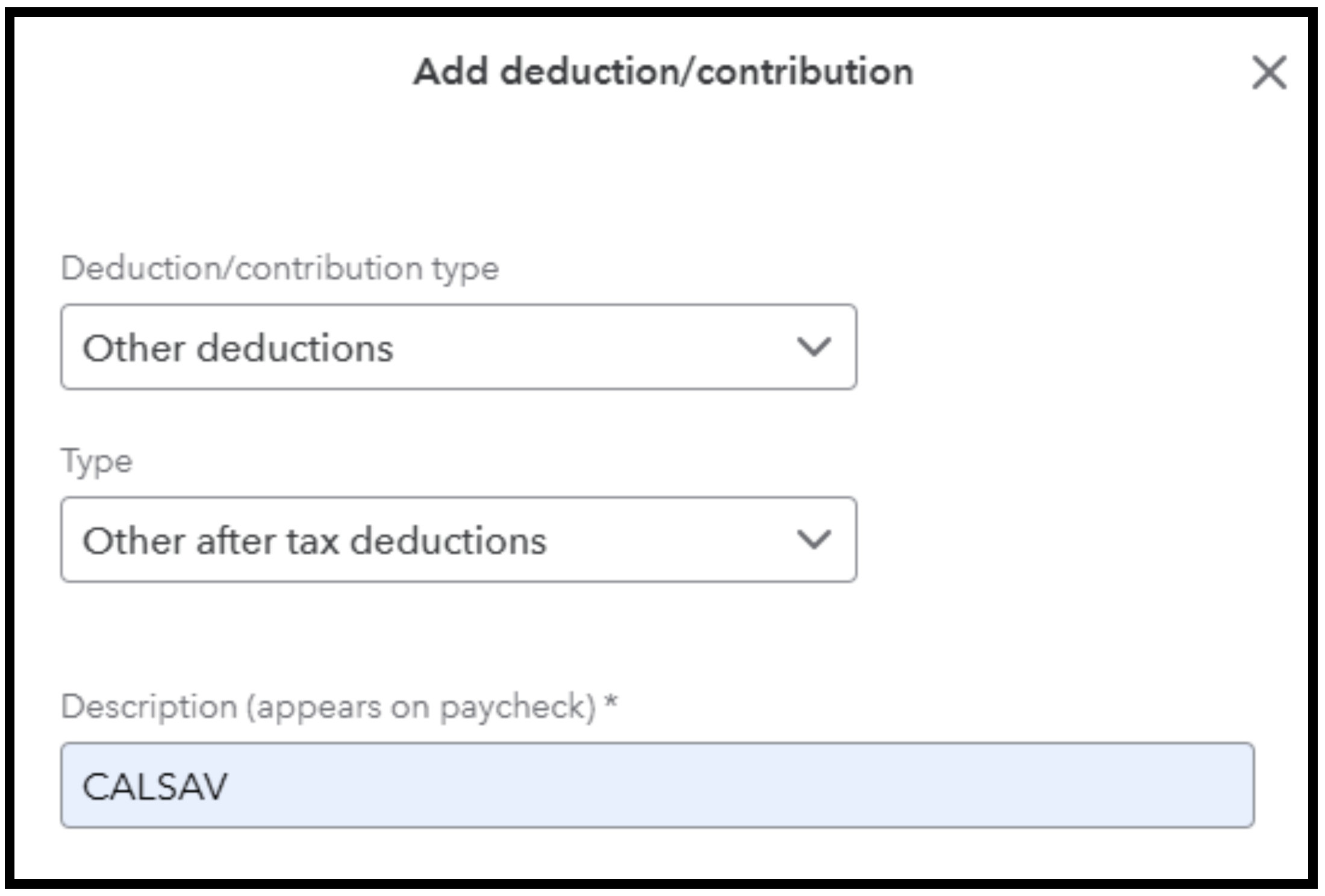

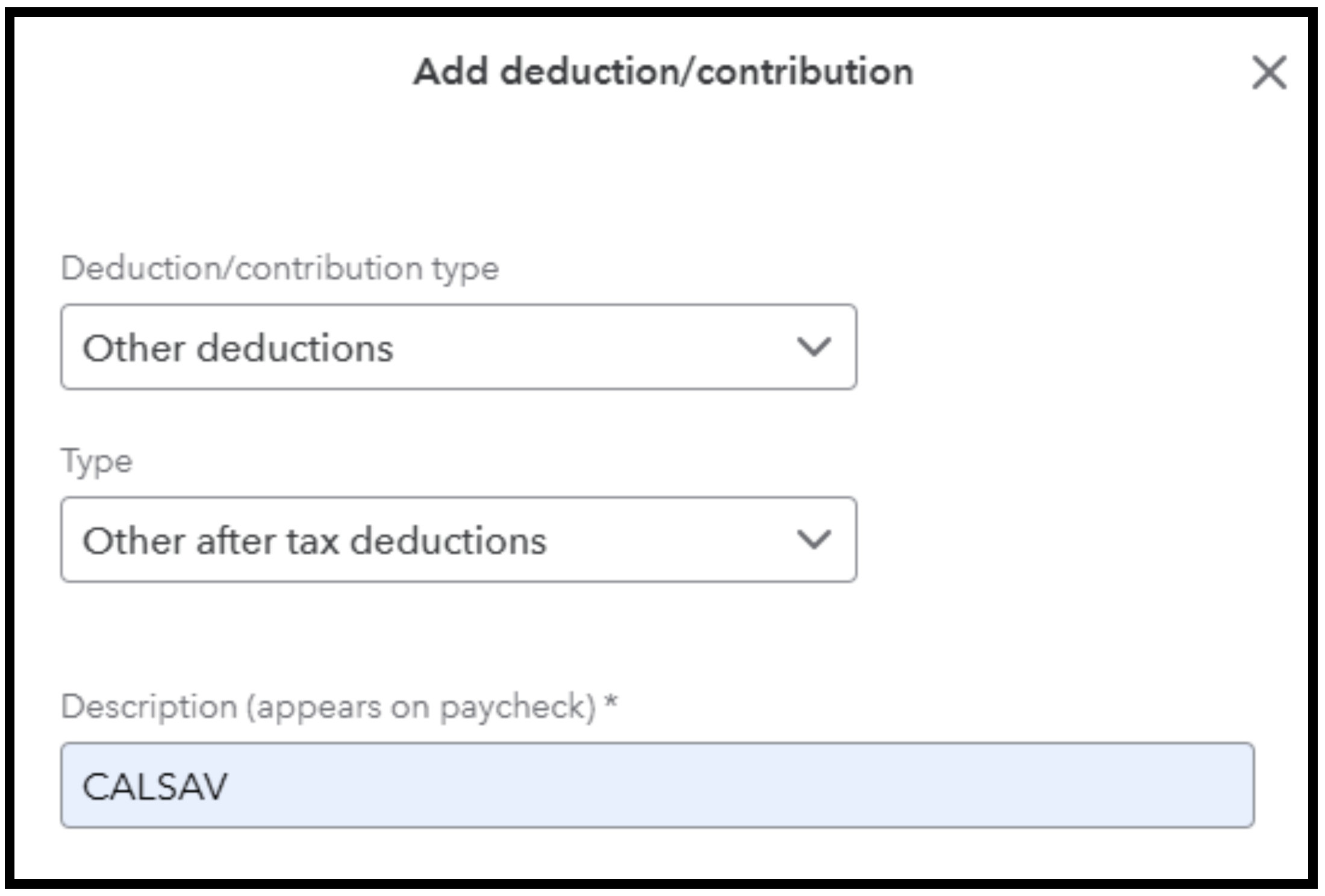

You can set up a custom after-tax deduction by choosing Other deductions from the Deduction Type dropdown. I’ll walk you through it.

Since CalSavers is an after-tax Roth IRA and isn’t listed in the dropdown, here’s how you can add it manually:

If you have any other questions, just hit Reply. We're here to help!

Hey Ann,

You can set up a custom after-tax deduction by choosing Other deductions from the Deduction Type dropdown. I’ll walk you through it.

Since CalSavers is an after-tax Roth IRA and isn’t listed in the dropdown, here’s how you can add it manually:

If you have any other questions, just hit Reply. We're here to help!

Hello, Ann.

I wanted to follow up on your concern and see if the solution we provided has resolved your issue. Please let us know if everything is now working as expected or if you have any questions.

We’re happy to assist you further. I look forward to hearing from you.

Thank you so much for your time! Very much appreciated!

It worked like a charm!

Hello there, Ann.

We’re pleased to know that the solution provided by my colleague @EmanE17 has answered your question and helped you achieve your goal.

Feel free to return if you have any additional questions or need further assistance. We’re here to help. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here