You need to set up the same individual with two separate profiles in QuickBooks, @josbodybalance-g.

If you already set up an employee in QuickBooks, you need to create a separate contractor profile. This way, you can properly track different payment types, tax liabilities, and issue the correct tax forms (W-2 and 1099-NEC) at the end of the year.

Also, QuickBooks does not allow two records with exact the same name. You need to create the contractor record with a slight variation of the name to distinguish it from the existing employee record.

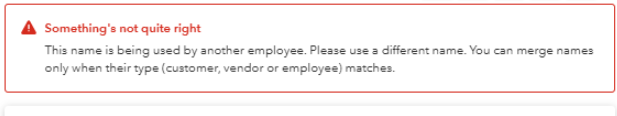

This is the error you’re going to see if you use the same names:

Here’s how to add your employee as a contractor:

- Go to Payroll and select Contractor.

- Click the Add a contractor button.

- Enter the name, but add a unique identifier to it. Example: If the employee is "Mary Jane," enter the contractor as "Mary Jane C." or "Mary C. Jane."

- Enter the contractor's email address.

- Click Add Contractor.

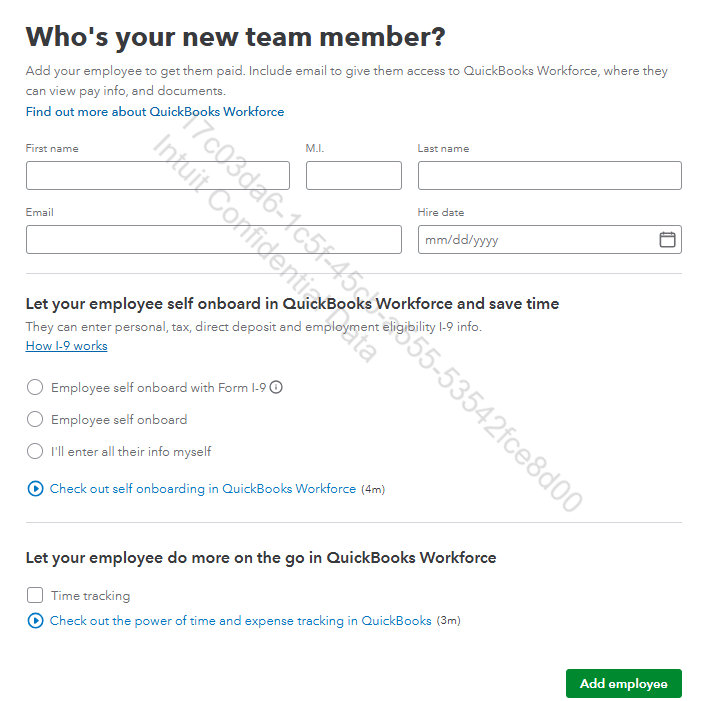

However, if this is a brand-new employee and you haven't yet set up their profile in QuickBooks, here is the setup process:

- Go to Payroll, then select Employees.

- Click the Add an employee button.

- Fill in your employee's details.

- Once done, click Add employee.

After that, you can follow the steps above on how to add your employee as a contractor.

Feel free to message us again if you have further questions.