Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Good day, @rupinder,

Thanks for checking this with us. I want to make sure you get your California employer account number.

If you're referring to the payroll tax account number for filing returns and making deposits in all electronic and paper filings, you can get that by signing up to e-Services for Business.

Once your business is registered with the EDD, you will be given an eight-digit employer payroll tax account number, also known as a State Employer Identification Number, SEIN, or state ID number.

You may want to check these links to know more about the process:

You can also contact your state agency directly to know what are the requirements and to get further assistance with the registration.

Please let me know if you have additional questions. I'll be around to help you anytime. Have a good one!

Where do we enter this number? It's not in Payroll Settings and I can't make state deposits - this is so very frustrating. The Help Files are completely worthless - why bother to even have them?

Hey there, @KMat. Thanks for joining the thread.

I'm here to help. The way you enter your account number varies by the type of payroll you have. If you're on our Enhanced (Self-Service) Payroll subscription, you can enter it by following the quick and easy steps I've provided below. If you're on our Full Service Payroll options, you'll need to get in touch with the QuickBooks Online Customer Support Team so that they can update the information for you.

That's it! Please touch base with us here if there's anything else you need, I'm determined to ensure your success.

Hello!

I am also having this problem - I just set up my Core Payroll Quickbooks account and can't figure out how to get a California Employee Account number. I do have a FEIN (tax id number). Will I get a California Employee Account number automatically by registering for E-filing? I just tried to call my state EDD and there were so many calls that they disconnected my call.

Thank you!

Hello there, @Irowley1.

Let me share some information about the California Employee Account number.

When you register for E-filing, it is only for submitting tax documents to Internal Revenue Service. It will not automatically generate an Employee account number.

You’ll need to contact your state agency to get information on how you can get the California Employee Account number. You may also use the instruction given above.

I’m adding here a link where you can search an article if you need some information or procedures while using QuickBooks Online. Help article.

If you have any other questions, please let me know. I am here to help. Have a good day!

I SETT UP MY CALIFORNIA TAX EMPLOYER ACCOUNT BUT I CANNOT FIND THE TAX NUMBER

Hi @Sam_1908,

I'll point you in the right direction for support with your query.

As stated by my colleagues above, you'll have to contact EDD and register through them. They are the ones who will provide you a State Employer Identification Number (SEIN).

If you're looking for the location where to enter this information, follow the steps below:

In case you want to file your taxes electronically, open this article: Enroll in E-File & Pay. It also has a list of common questions at the bottom of the page, in case you have concerns with the feature.

Feel free to press the Reply button if you have other concerns. I'll be sure to take care of it.

Phone number?

Wouldn’t I have that to set up checking account?

How can I print W2 without ca employer account number?

I'm glad you made it here, DerekCarmichael.

Before printing W2's in QuickBooks Online (QBO), it requires complete information and one of them is the employer account number or your Employer Identification Number (EIN).

If you don't have it yet, you can get that by signing up for e-Services for Business. Once your business is registered with the EDD, you will be given an eight-digit employer payroll tax account number, also known as a State Employer Identification Number, SEIN, or state ID number.

You may want to check these links to know more about the process:

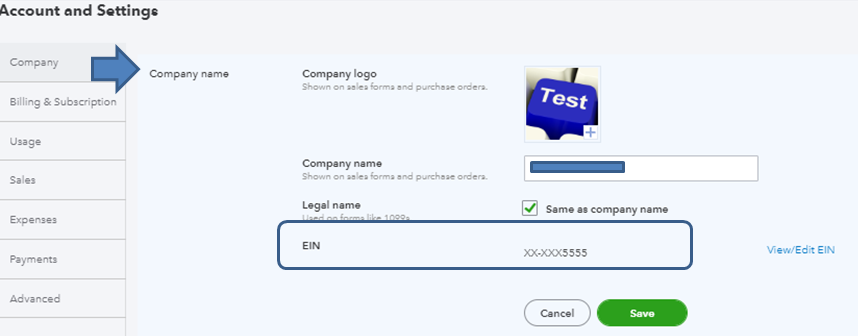

Then, you can enter your company EIN can be found by following the steps below:

Learn more about printing W-2 forms in QBO through this article: Print your W-2 forms.

In case you need a reference when filing W-2's, here's an article made handy for you: File your W-2 forms.

Know that you're always welcome to post here in QuickBooks Community if you have any other concerns.

Hello where do I find setup tab

Hello where do I find setup tap?

Thanks for joining the thread, @Va30.

If you're referring to the Tax Setup tab, you can see it after clicking the Payroll Settings. Here are some screenshots as your visual references:

I've included links on how to set up electronic tax payments and filing and how to file and pay them in QuickBooks:

Please get back to me if you still have payroll setup questions or concerns. I'm more than happy to answer them for you. Take care and stay safe.

I cannot enter my id number as it is fixed to accept xxx-xxxx-x. My id number for CA is 12 digits that have no dashes. Somebody please help me with this!

Thanks for joining this thread, @Soo2. I’ll make sure this ID number concern gets taken care of.

Since your CA ID number has 12 digits and no dashes, it would be best for you to contact our support. They can help you find more solutions and ensure it’ll be successfully set up on QuickBooks.

Here’s how:

I’ve added a reference to learn more about managing your payroll and financials: 10 expert tips on how to stay payroll compliant. It helps you stay organized and compliant, along with useful advice, tips, and strategies.

Don’t hesitate to add a comment if you have any other questions or concerns besides entering ID numbers. We’ll always be here to help. Take care!

Thank you MadelynC,

The error was actually that I didn't understand what number I needed to have in the state tax ID Employer Withholding. As I hsd entered the FEID on the previous page, I expected the CA ID to be entered on that page. But, what I needed was to go to the CA FTB, register, and then obtain a number for payroll use. There was nothing QB could have done except not give me the wrong advice.

Yesterday I was told to just put in some part of the 12 digit number that I had, as a placeholder, so that I could get payroll set up and I would be able to crorrect it later. Today, when I got the correct number, I couldn't enter it because I had already enrolled in CA EFT. So I needed another QB representative to undo what I had done and then actually put in the correct number. It was a long process, but at least we got there in the end.

Thank you very much for your effort to help.

usually EDD send a letter that has XXX-XXXX-1 format account ID .just input that .

on the contrary what you are referencing is the account number from California secretary of state that will not work here .

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here