Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe currently use Gusto for our payroll. We input the hours, they give us a payroll withholding breakdown by employee. We record and print the paychecks manually. Gusto debits our bank account for both the employee and employer portions of the taxes. The issue is when I run payroll and input the withholdings for the employee's checks it is double recording the employee withholding amounts since that is also a portion of the weekly debit from Gusto. How can we avoid the double recording????

I'm here to make sure there are no duplicate entries when recording payroll withholding, @Pallywag Grp.

We can use expense transactions to record the payroll expense and match it to Gusto's weekly debit to avoid double entries.

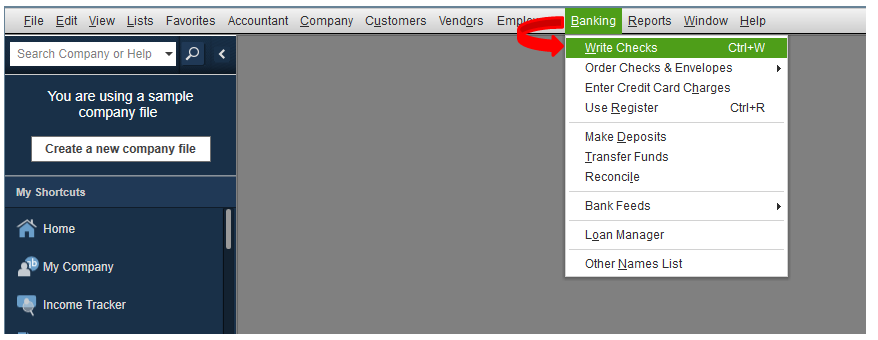

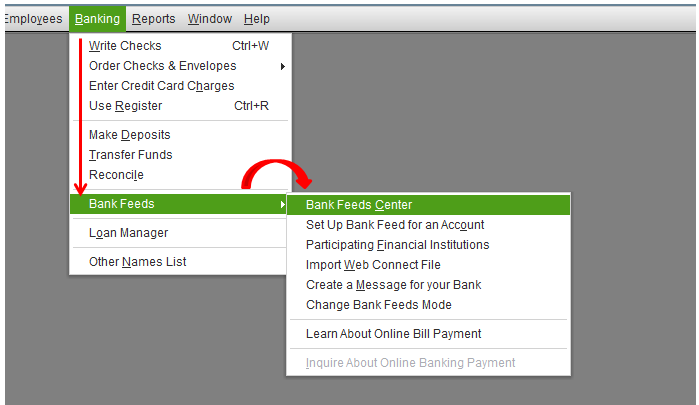

Here’s how you do it:

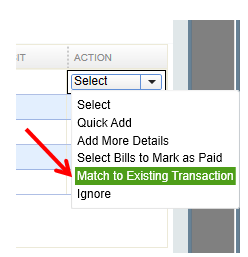

After, you can follow these steps below to match the event to the bank transaction:

I have an article here that has information about tracking expenses. This gives you an idea of how to handle them in just a short period.

You can get back to me anytime if you have additional questions. I’ll be here to assist you.

Explore this connector and utilize the trial period of it. You may find something useful for your case.

https:// synder.grsm.io/quickbooks

Gusto usually shows three transactions on bank statement:

- Net Pay

- EE Taxes

- ER Taxes

The first two added together equal employee Gross pay.

EE taxes are not an expense on company books, they are part of Gross pay.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.