We are a Scorp. The sole shareholder purchased the health insurance in his name (he is the company's only employee and is paid by Direct Deposit). We need to reimburse the shareholder for the health insurance and include the premium payment in his W2 (Boxes 1 and 14).

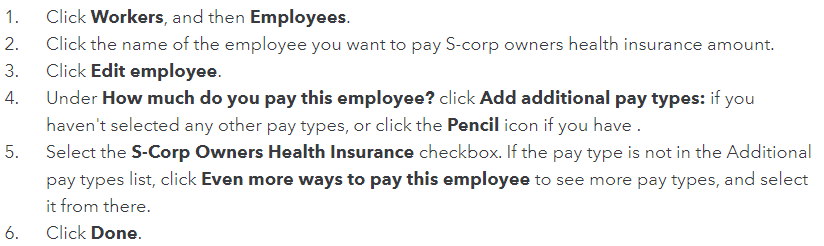

I've followed the steps below already.

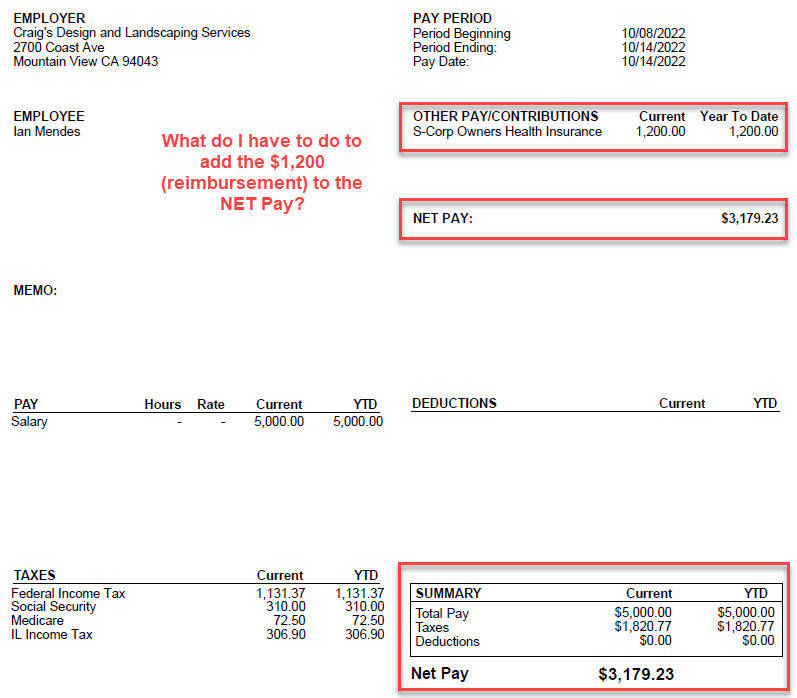

The point is, following these steps doesn't change the NET Pay in the paycheck.

I'll show an example with an illustrative paycheck.

I believe that if the company directly paid for the health insurance, the steps in Image 1 would be enough. However, since the shareholder will pay the premium with his funds, we must reimburse him. How do I do that? Following the steps of Image 1 doesn't actually "transfers" him any money.

Any help will be more than appreciated!

Thanks!