Accurately marking your Form 941 payment is crucial for proper payroll records and easy access to your reports. I'll show you how to correct this and ensure everything is in order, info-air.

If you choose to pay for and file your tax filings yourself, you may be able to cancel tax payments.

If you let QuickBooks handle tax payments and form filings automatically, canceling it yourself isn't possible. If this is your case, I recommend contacting our payroll support. Our experts can check and assist you in correcting your Form 941 payment.

For more details, check out this article: Cancel or delete payroll tax payments and forms.

Since you mentioned that you have accidentally marked it as paid, we can delete the payment to unmark it:

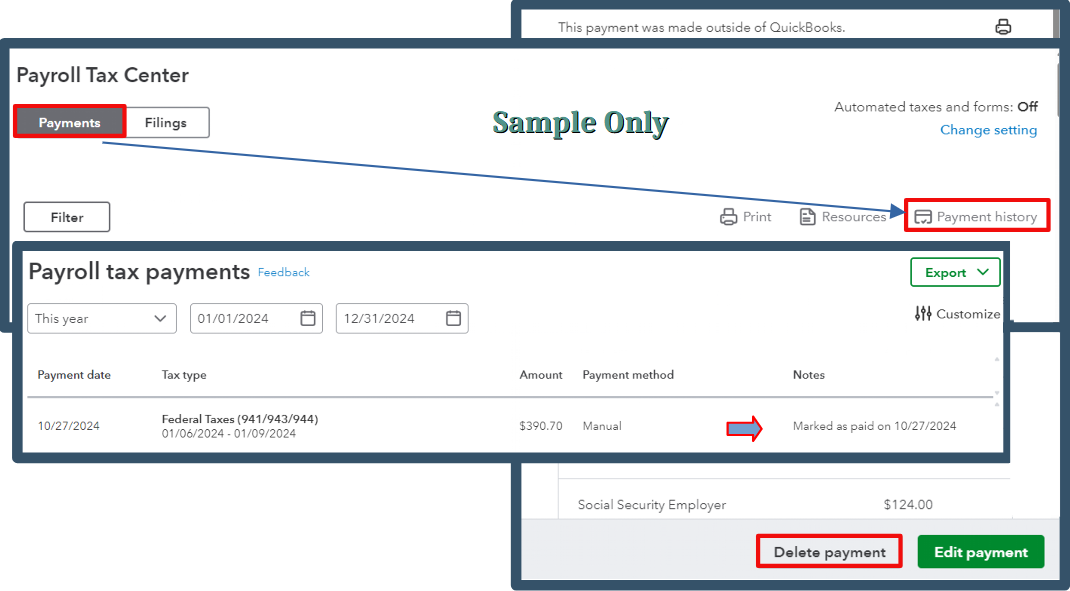

- Head to the Payroll menu, then Payroll Tax.

- On the Payments tab, select Payment History. Locate the 941 payment and click it.

- Hit Delete payment.

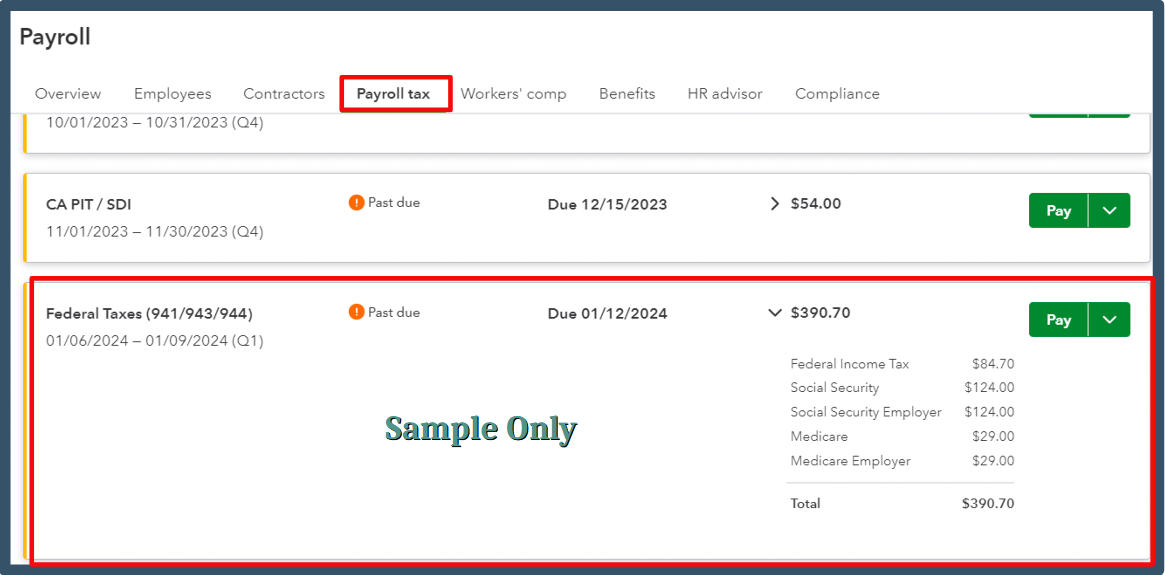

Now, return to the Payroll Tax page. Please see the attached screenshot for visual reference.

If you want to access your employee's wages, taxes, deductions, and contributions immediately, you can generate a Payroll Summary report.

For future reference, you can run a payroll report to get a detailed summary of your company's payroll expenses, including employee salaries, bonuses, taxes, and other related costs.

I hope the steps above guide you well towards a resolution. Please let me know how everything turns out. If you have any further questions or need additional assistance with your payroll tax payments and forms, don't hesitate to click the Reply button below. Have a great day!