Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Greetings, @jacobi-schall.

I can guide you how to apply the Employee Retention Credit to your employees. Before we start though, can you share with me the instructions you’ve read? Additional details are appreciated.

Nonetheless, to apply the credit for your salaried employee, you’ll need to set them with the pay types so you can apply it to them. Here’s how:

Then run payroll using the pay types:

You can also check this link to learn more about how to track the Employee Retention Credit in your QuickBooks Online (QBO) account.

I want to make sure you’re in compliance with the federal tax regulations. I got you this article for reference: Internal Revenue Service Payroll Tax Compliance.

Let me know if there’s anything else you need help with by leaving a reply. I’m only a few clicks away from you.

How do I enter data for a salaried employee?

I'd be glad to walk you through the process of entering your salaried employee's data in QuickBooks Online, bw.

You can use the Enter prior pay details to record the previous payroll data for your salaried employee.

However, please be reminded that this option only available for the current calendar year and there are no paychecks created for the employee yet.

Here's how:

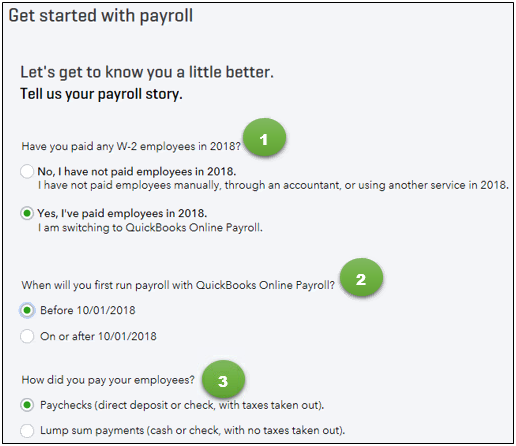

(See Have you paid W-2 employees in the current year for more details.)

For the complete details about this process, you can go through this article: Set up a prior payroll.

On the other hand, if you already have paychecks created, I highly suggest contacting our Payroll Support team. They have the tools that can help you enter the data.

Please be reminded that our Support Team is available from 6:00 AM until 6:00 PM from Mondays to Fridays. Here's how to contact us:

1. Click the Help (?) icon.

2. Choose Contact Us.

3. Enter a brief description of your situation in the What can we help you with? area, then click Let's talk.

4. You'll be presented with a few options for connecting with Intuit. Select Get a call.

Additionally, for your payroll reference: Payroll 101. It contains more information about the different types of compensation as well as on what are the types of federal forms you need to file. Also, this will provide you a sample breakdown of a paycheck.

Please know that you're always welcome to post if you have any other questions about entering other data or any QuickBooks related concerns. Wishing you and your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here