QuickBooks auto-populates the necessary fields when preparing Form 941 based on the payroll data entered, @rbgarris. Let me guide you through setting up a payroll item for tips and running payroll to ensure these amounts are accounted for and properly reflected in the correct sections of the document.

We can start by determining which type of tips your employees have received. Since your payroll separates this information for each employee, it’s essential to confirm whether they're classified as Cash Tips or Paycheck Tips.

Next, set up a payroll item for tips to ensure everything is accounted for properly. Please follow these steps:

- Go to Payroll, then Employees.

- Choose your employee.

- From Pay types, click Edit.

- In Additional pay types, pick Cash Tips or Paycheck Tips.

- Hit Save to finalize your selections.

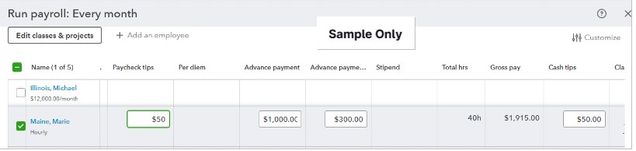

After that, let's run a scheduled payroll and enter the tips amount. Here’s how to do that:

- On the Employees page, select Run Payroll.

- Choose the appropriate schedule for this payroll run, then Continue.

- Review the Pay period and Pay date.

- Check the boxes of the employees you’d like to pay.

- In the designated column, enter the pay details.

- Click on Preview payroll to review the entries.

- Confirm the QuickBooks Bank account to track your payroll.

- Proceed to Preview payroll details or Submit payroll.

- Once you’ve verified all information, hit Close.

To assist you in completing Form 941 and understanding how QuickBooks populates the lines on the form, please refer to this article: How QuickBooks populates Form 941.

We can also generate a Payroll Summary report to review your employees' payroll totals, including taxes and contributions, as well as their information.

Explore QuickBooks Payroll to elevate your payroll processing capabilities. Its features can assist you with managing employees' tips effectively.

With all that, you can ensure Form 941 is set up accurately to report tips. If you have further questions about this process, please don't hesitate to comment below. That's it for now. Have a great day!