Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDue to the very annoying fact that I couldn't bypass the "Tax Penalties May Apply" screen, I had to put a later date on a manually-written payroll check that I hadn't entered into QBO yet. I truly didn't want to do it, knowing it would throw off my quarterly reports. The checks were manually written on June 10th, but I didn't get them entered into QBO Payroll until July 31st. It wouldn't let me enter the date any sooner than July 1st, due to the "Tax Penalties May Apply". If it fell within the same quarter, I wouldn't worry about it, but obviously, it doesn't. Did anyone ever get a resolution to this, other than calling Customer Support and spending an hour deleting/changing through screen share? We pay enough each month that we should be able to put whatever date into it that we want. I fully understand the Tax Penalties warning, but we should be able to bypass it and move on. I have had QuickBooks for approximately 25 years and had always loved it. I switched to QuickBooks Online in January of 2021, and it has made me not much of a fan of QuickBooks any longer. I would appreciate any help or suggestions any of you may have.

Thanks for posting here, @userkuhnfarms. I'm here to help you change the date of the payroll checked entered in QuickBooks Online (QBO).

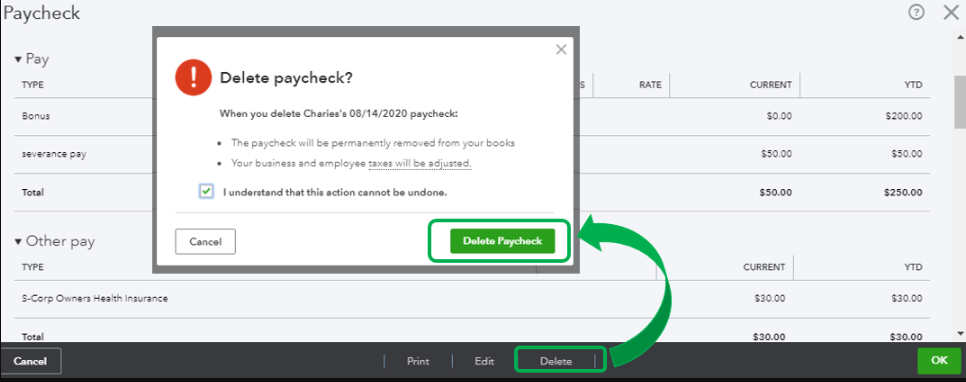

I appreciate you sharing the detailed information about your concern. To resolve this, you'll have to delete and recreate the paycheck. Follow along below to get this done right away.

Once done, recreate the paycheck with the correct date. For reference about managing payroll in QBO, check out this article: Create and run your payroll.

Additionally, the program offers a variety of payroll reports that you can access to easily monitor your employees and account info. For the complete list and their description, feel free to check this article: Run payroll reports.

I'd love to know how the steps go. I'd appreciate any updates you can add. If you have additional questions about creating paychecks in QBO, feel free to post a comment below. I'm always around and ready to lend a hand. Have a good day and take care.

Before I attempt to do as you suggested, I want to make sure that I can enter the date of June 10th (or no later than June 30th), which is the date the checks were written, without getting the aggravation of the "Tax Penalties May Apply" message that I cannot bypass. I do not want the payroll shown in 3rd quarter. Thank you.

Yes, you can enter the date of June 10th, userkuhnfarms.

QuickBooks Online Payroll lets us create unscheduled payroll so we can recreate and correct deleted paychecks. We can follow the steps to complete the process:

To know more about how payroll works in QuickBooks Online, we can scan through the following resources below. These will provide us with a brief video to serve as our visual guide:

Get started with QuickBooks Online Payroll.

If you still have follow-up questions about this, please let me know, userkuhnfarms. I'd be more than willing to provide additional assistance.

I was able to delete the paychecks with the incorrect date. However, it still will NOT let me save these paychecks with the June 10, 2022 date, because it says it's out of the pay period, reporting period, whatever.....This is beyond frustrating. I am normally a very patient person, but QBO is testing my patience majorly. I sure would appreciate any help with this fiasco. Thank you.

Hello there, @userkuhnfarms.

Let me help you recreate the paychecks in QuickBooks Online so you can change the date.

Here's how:

To learn more about what can and can't be edited or deleted on a paycheck in QBO, you may check out this article: Change an employee paycheck.

Please feel free to leave a message to this post if you need further assistance. I'm always here to guide you. Enjoy your day!

None of these suggestions/instructions work!!! It will not let me save the paychecks with the date of June 10, 2022, because it is in a prior quarter. However, that is truly when the checks were manually written. I just hadn't entered them into QBO yet! This is so ridiculous. I've had some version of QuickBooks for 25 years or more, and I know what I am doing. Would someone please just tell me that I need to call Customer Support to have them do it by screen share or whatever? I will be asking for a credit on my account for this ridiculous issue.

This is not the kind of experience that we want you to have trying to save paychecks, userkuhnfarms.

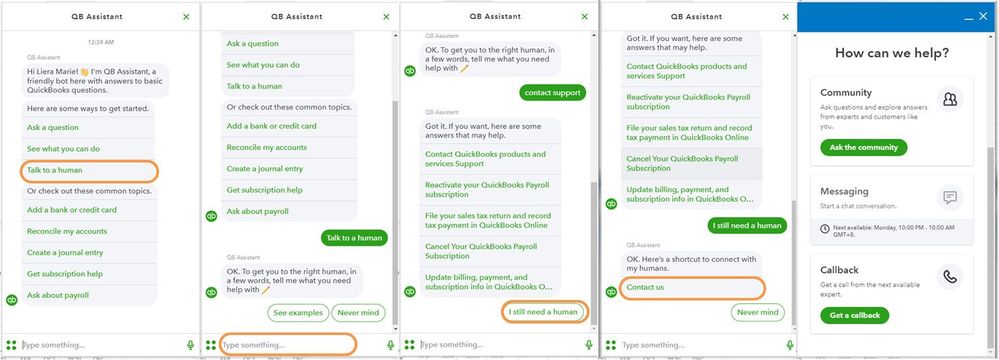

I understand that you've already exhausted all the resources just to get this resolved. You'll want to get in touch with our support team. This way, we'll be able to pull up your account in a safe session and they can take a look at your screen.

Let me also share this article to get their contact details and business hours: Contact Payroll Support

You can always visit our help articles in case you need some information about QuickBooks payroll.

Let me know how the call goes. I'll be around to assist in case you still need more help. Take care.

It won't let me change the date either as it says Tax Penalties may apply.. Just have an override button for goodness sake.. WTH!! SOOOOOOOOOOOOOOOOO beyond frustrated...

We understand how you feel regarding the inability to change the date of a manually entered payroll check and the concern about potential tax penalties, @Linda1260.

Rest assured, we take your feedback seriously and understand the need for more flexibility in such situations. To address this issue, we recommend reaching out to our Customer Care Support team. They have the expertise to assist you further and provide any necessary assistance with overriding the information if needed.

Here's how:

Furthermore, we value your feedback and encourage you to share any suggestions or concerns you may have about this feature or any other aspect of our product. You can share your thoughts by navigating to the Feedback section.

Moreover, you'll want to run payroll reports to get valuable insights and information about your company's payroll expenses, taxes, and employee compensation.

We appreciate your understanding and patience in this matter. Should you have any additional questions or need further assistance, please don't hesitate to let us know. Our team is here to support you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here