Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThank you jeniferloras for joining this thread and for providing steps to void the check. Allow me to join and share another way to reverse the bill payment, eugenepalletserv.

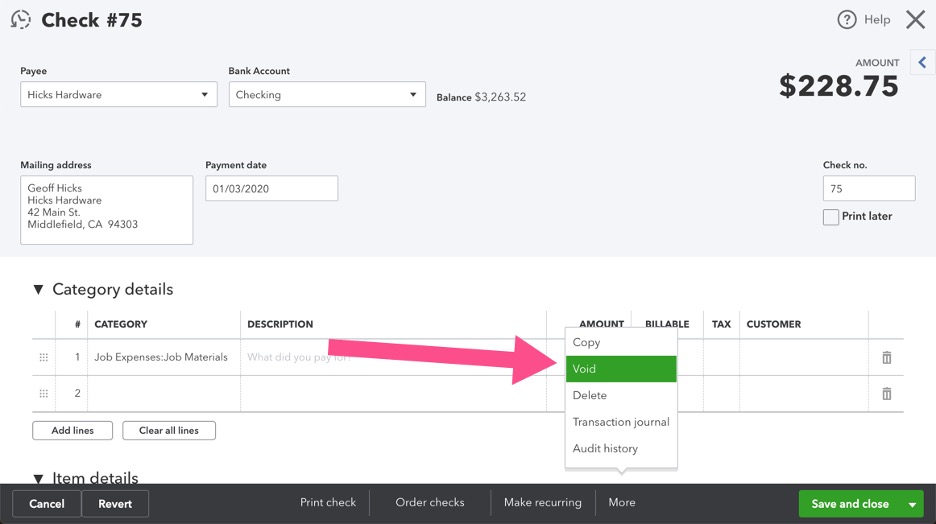

In QuickBooks Online, you can reverse the original check by voiding it through the Expenses page. Here are the steps you can follow.

Voiding a check will still have a record of the transaction, but it won’t affect the account balances or reports. If you want to completely erased it from your books, deleting it is another option. Please refer to this article as it'll walk you through the differences: Learn how to void or delete invoices, expenses, and other transactions in QuickBooks.

If you aren't sure whether to void or delete a transaction, reach out to your accountant. If you don't have one, here's how to find a ProAdvisor.

Leave a comment below and tag me if you need more help with reversing a check. I'm always glad to help you.

The original check was paid through bill pay and has already been reconciled. Would I still void it and reissue? Wouldn't that mess up the reconcilation

Thank you

Lori

Thank you for coming back to the Community, @eugenepalletserv.

I'll make sure to assist you in your confusion about whether you need to void and reissue your reconciled Bill Pay.

Since you mentioned that your transaction on Bill Pay had been reconciled, I recommend consulting your accountant to confirm if you need to void and reissue it.

If your accountant advises you to void your reconciled transaction, then this will unbalance your past reconciliation

Once the transaction had been voided, you can check this link to help you bring your reconciliation back to balance: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

If you see a small amount left over at the end of the reconciliation, you can read through this article to learn what you can do to fix it: Enter an adjusting entry for a reconciliation in QuickBooks Online.

Don't hesitate to reach us back or leave a reply if you need further assistance with voiding a reconciled transaction. I'll help you anytime. Keep safe.

I can help and answer any questions you may have about QuickBooks, @jeniferloras.

However, I have to gather some information about your concern to ensure I can provide the best solution.

While we wait for the information, you may want to check out one of our Help pages as your reference to guide you in managing your business growth and transactions using QuickBooks Online (QBO): QuickBooks Learn and Support. It includes help articles, Community discussions with other users, and video tutorials, to name a few.

I'm looking forward to your reply. Thank you in advance, and have a great day.

Thank you for your question, If the original check was already paid through bill pay and has been reconciled, voiding and reissuing it might disrupt the reconciliation process. It's recommended to follow the appropriate protocol for handling such situations in your specific accounting system or consult with a financial professional to ensure the reconciliation remains accurate. They will be able to provide you with the best course of action based on your specific circumstances and the reconciliation process in place.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here