Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

If you don't have EIN, but SSN or ITIN, and your company is B2B, you can use a 3rd party processor to accept payments with your QBO.

Hello there, Reslock. I agree with Chrea that using a third-party processor to accept online payments in QuickBooks Online (QBO) is a great option. I'm here to guide you through the steps.

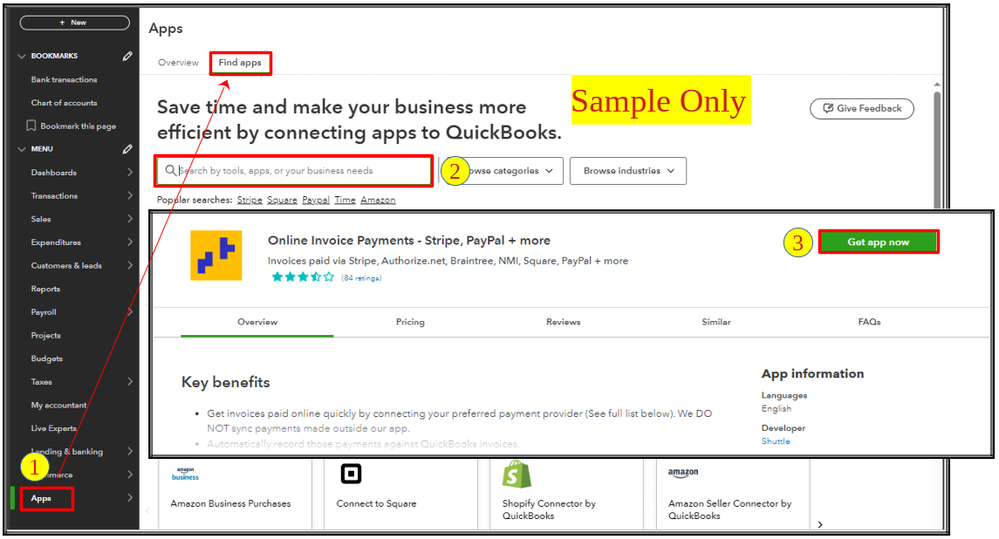

Before we proceed, please note that having an Employer Identification Number (EIN) is essential for successfully registering for QuickBooks Payments. That said, please refer to the steps below to find third-party payment processors to accept your online payments.

Additionally, you can refer to these articles about managing your bank transactions in QBO:

Let us know if you have other concerns about accepting online payments in QBO. We're here to help you in any way we can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here