Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowI have an Oregon state transit tax calculating on my payroll but it doesn't apply to the county we are located in. I made it invalid but it still calculated... is there any way to remove that transit tax line item? This is the first time I have run payroll through QB and it's got me stumped! Our business is in Multnomah County, so we have to pay the Tri-Met Transit Tax, which it correctly calculates. Unfortunately it is also calculating the Lane Transit District Transit Tax, which only applies if you live/work in Lane County. Any help would be greatly appreciated!!

Cheers,

Todd

I'll help you remove the Lane Transit District Transit Tax, tschur.

Let's edit your employee's profile to remove transit tax line items when running payroll in QuickBooks Desktop.

Here's how:

For more details about the process, please see this article: Change State Taxes for an Employee.

Additionally, I've included an article that will guide you in ensuring your compliance with state payroll tax regulations: Internal Revenue Service Payroll Tax Compliance.

In case you'll need assistance in dealing with payroll tasks, please don't hesitate to get back on this thread. I'm always here to help you.

Hi tschur,

Hope you’re doing great. I wanted to see how everything is going about removing that transit tax line item you had yesterday. Was it successful? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Hi there, I followed the steps listed as I have a similar situation, but the employee's wages that mistakenly had the Lane County Transit tax are in the Oregon OQ form. Several paystubs had this accrued (it is paid by the employer and not the employee). I can't find a way to remove it from the OQ.

Hey there, ehutchison.

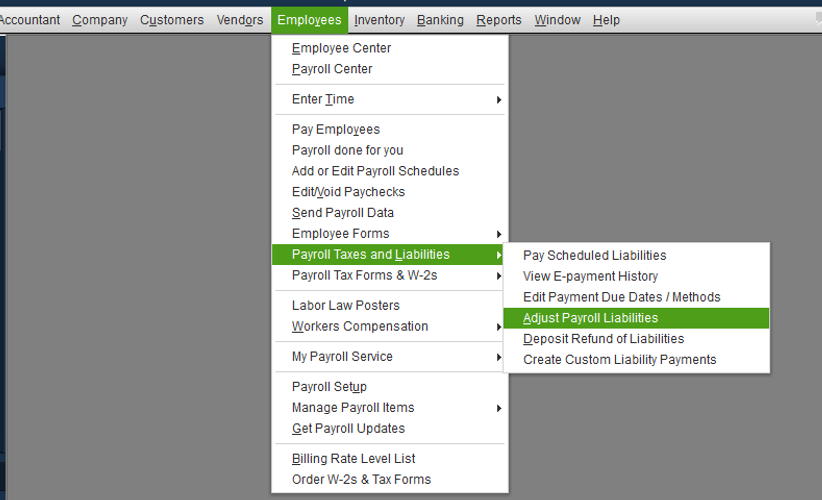

To get this sorted out, you'll need to do an adjustment to remove the wages from the OQ. Here's how:

Once done, go back and check the OQ. For more details about this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, you'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Let me know how the result of this troubleshooting in the comment below. I want to make sure you're all set. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here