Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm here to lend a hand with your inquiry regarding client invites in QBSE, lurenda33.

You can utilize the same email address to complete your W-9 for the new client. One unified login works across all client that uses QuickBooks to manage 1099 contractors.

Once you have received the link, there is no need to create a new account as you already have one. Simply log in to your existing account and proceed to fill out the form.

Here's how:

Additional details about accepting invitation, filling out 1099, and viewing 1099s are also discussed here: Fill Out a W-9 and View Your 1099-MISC in QuickBooks Self-Employed.

That will help you get started with this new client and complete the forms, lurenda33. If you need any further assistance, the Community is always available to help you with anything else you may need.

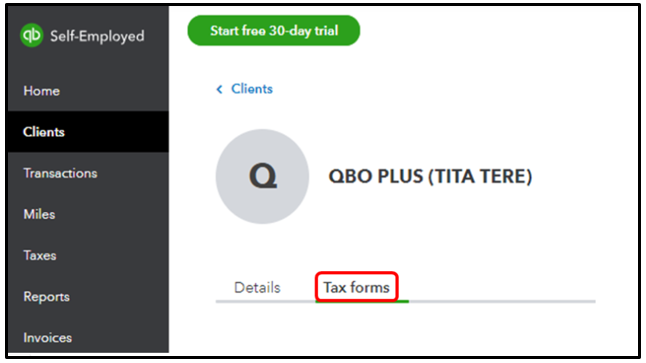

This is great information! Thank you. Unfortunately, when I go to the tax form tab there is no W9 listed for me to enter info in.

It says, " when clients use QuickBooks Online to e-file, your 1099s are automatically posted here."

Here is the message I received from the client:

"In order for me to set up your bill.com payments, QuickBooks needs to have your tax number and other information.

I am trying to send your invitation from bill.com, it just doesn’t want to go out because all of the required information has not been added."

Is there another location where I can add all the information that the client is requesting?

Hi, lurenda33.

Thanks for getting back on this thread. Let me make it up to you by providing the information you need to complete W-9 for the new client in QuickBooks Self-Employed.

You can use a different email address where your client will invite you to fill out your W-9. Otherwise, if you received an invitation for the same email, you can click Sign in to simply log in to your existing account and proceed with editing or filling out your form. You can follow the detailed steps provided by my colleague above.

I'll be adding this article again for further guidance about this process: Fill Out a W-9 and View Your 1099-MISC in QuickBooks Self-Employed.

I'm still ready to back you up if you need more help managing your forms. I'll keep the thread open so you can comment back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here