Let's make sure you'll be able to exclude the wages of Montana Unemployment Insurance, olescs11.

In QuickBooks Online, you'll just have to go to Tax exemptions. Then untick the State Unemployment Insurance tax to exclude it from the reporting. To do this, follow the steps below:

- Go to the Payroll menu, then select Employees.

- Select the employee's name.

- Under Employee Details, click on the pencil icon beside Pay.

- Click on the pencil icon under the question What are (employee's name) withholdings?

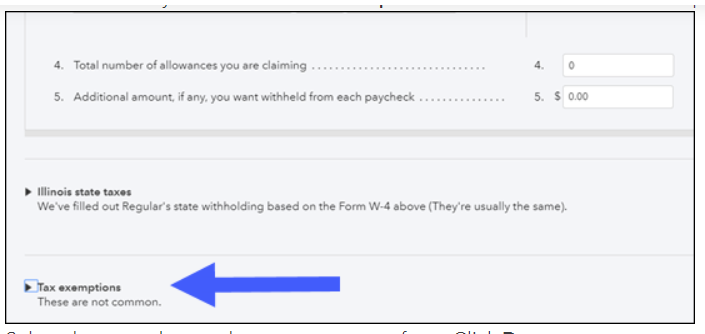

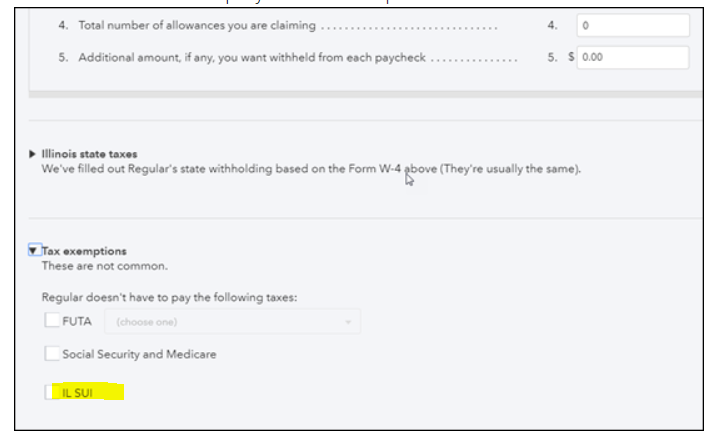

- Scroll down until you reach the Tax Exemptions section and click on the drop-down arrow.

- Select the taxes the employees are exempt from. Click Done.

However, if you want to update your SUI, check out the steps in this article: Update Your State Unemployment Insurance (SUI) Rate In QuickBooks or Intuit Payroll. Moreover, to ensure you'll get the information you need for your business ad employees. I've added this article for your reference: Run Payroll Reports.

You can always comment on this thread in case you have any concerns about changing SUI. I'll always be here to help.