I'm glad you made it here, bela1.

If you have already enrolled to the e-services in QuickBooks Online, you're unable to change the EIN. You'll want to unenroll the option to be able to change it.

Here's how:

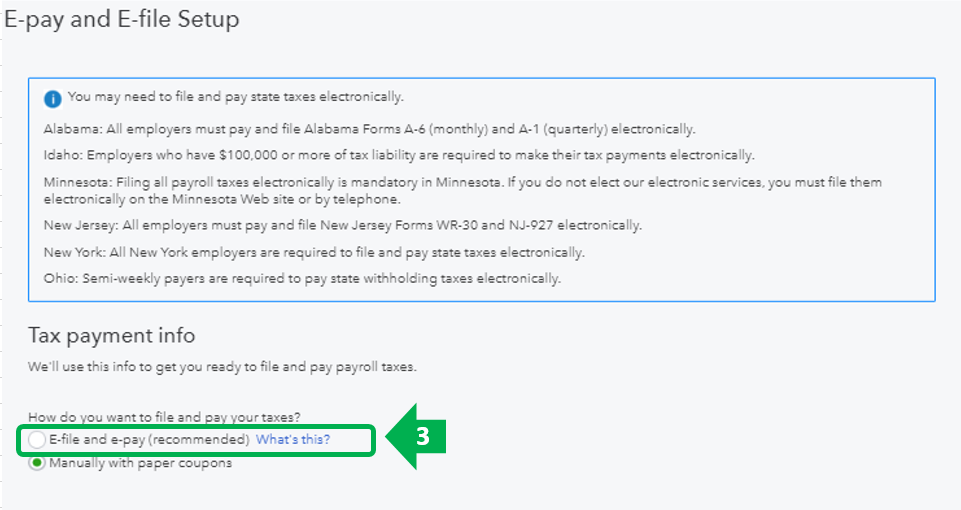

- Go to Taxes and choose Payroll Tax.

- Click the link for Edit your e-file and e-pay setup.

- Uncheck the radio button for E-file and e-pay.

Once done, you can change the EIN and check the E-file and e-pay option again to continue using the eservice.

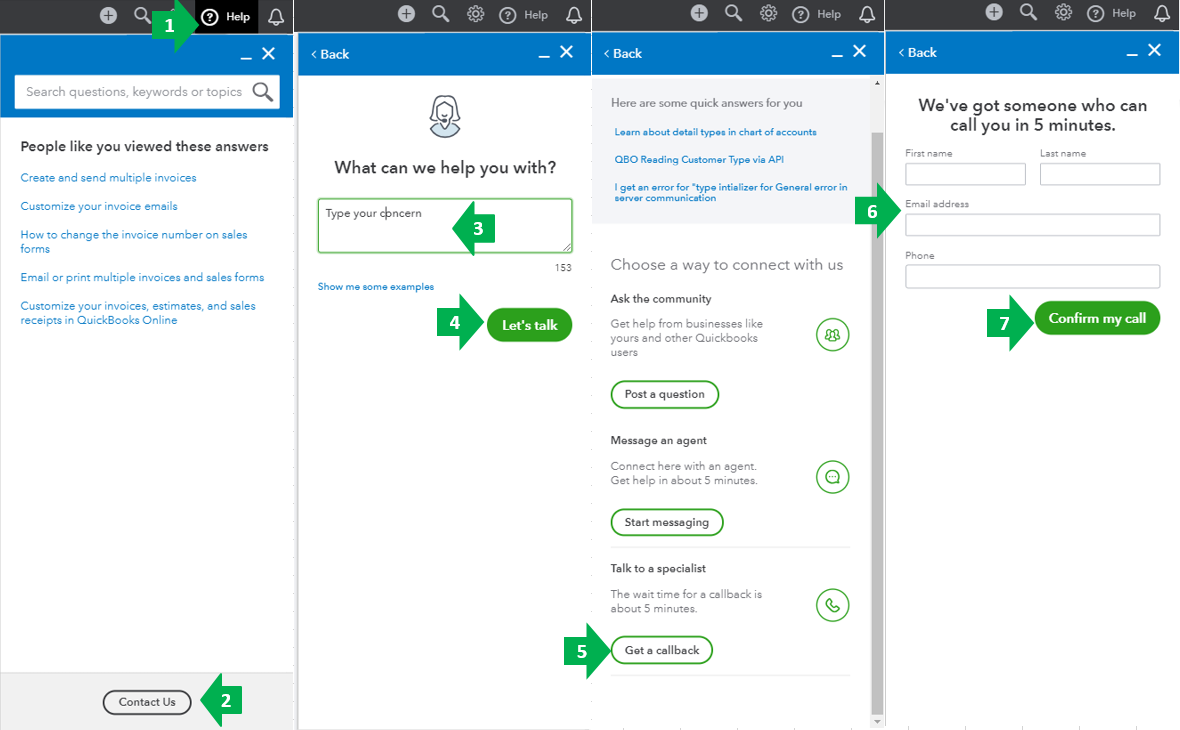

If you don't see this option, or using the QuickBooks Full Service Payroll, you'll need to contact our QuickBooks Care Support to help you with the corrections.

Here's how:

- Go to the Help menu at the upper right.

- Select Contact Us.

- Enter your concern.

- Click Let’s talk.

- Choose Get a callback.

- Type in your contact info.

- Select Confirm my call.

I’m always ready to assist further if you have other questions. Wishing you the best.