I know it's important to ensure you're able to record the commissions accurately, croyce. I've got you covered.

Before proceeding, I'd suggest asking your employee if the amount will be deducted through payroll or from the current commission.

To deduct the amount through payroll, I'd recommend following these steps:

- Go to the Payroll menu and then select Employees.

- Locate the name of your employee, then click it.

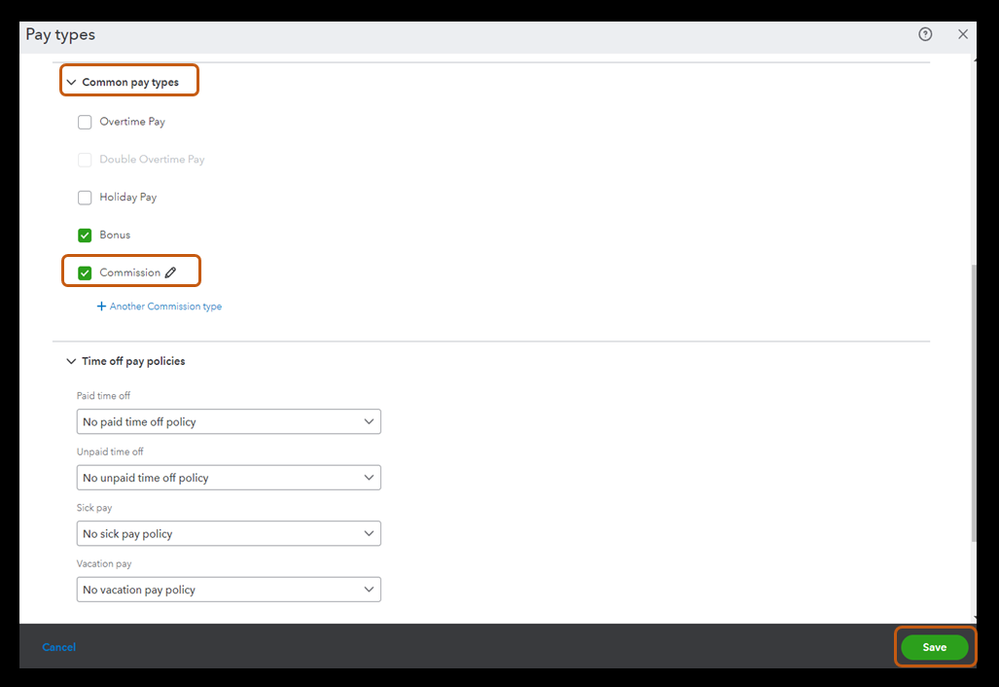

- On the How much do you pay [employee's name]?, click the pencil icon.

- Scroll down to Common pay types.

- Place a checkmark in the Commission box.

- Once done, click on Save.

For more details, please see this article: Pay Employees a Commission.

Otherwise, you can deduct the amount from their current commissions

Additionally, I encourage visiting our Payroll Help Articles page for reference. From there, you'll be able to learn more about managing employees and taxes in QuickBooks.

I'm only a few clicks away if you need assistance with your other payroll tasks, croyce. It's always my pleasure to help you out again.