The weekend is almost here, @jkothari.

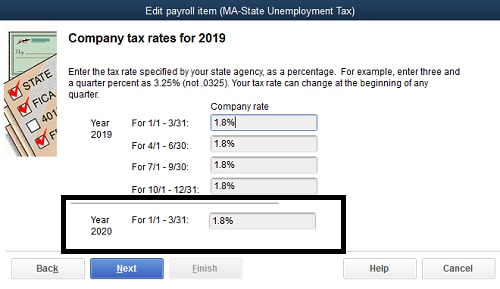

I've got some information I'm sure you'll find helpful regarding SUI rates in QuickBooks Desktop Payroll. For future periods (such as the first quarter of 2020), the most recently entered rate will automatically be updated to the next quarter when that period becomes available.

According to our detailed guide on changing SUI rates in Assisted Payroll, the field for each respective quarter's rate becomes available 6 months in advance. Here are the steps you'll need to update those rates:

Updating SUI in Assisted Payroll

- From the Dashboard, click the Lists menu > Payroll Item List. Select the State Unemployment Tax item, which is typically listed as your state's abbreviation followed by Unemployment Company.

- Click Next on each screen, entering the updated or most recent rates on each screen.

- Continue clicking Next after each rate then select Finish to save the information.

With the help of these instructions, updating SUI rates for current or future periods has never been easier. Please let me know if there's anything else I can do to ensure your success. Thanks for coming to the Community, cheers to an awesome rest of the day.