THE ISSUE:

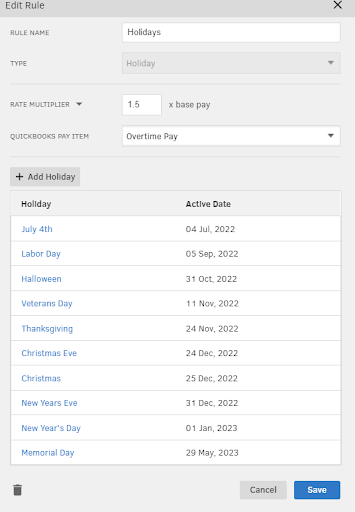

I am trying to pay designated holidays at 1.5x the base pay rate. I created a new pay rate, called Holiday 1.5 in Quickbooks Time. See the second screenshot to see this new pay rate in Quickbooks Time.

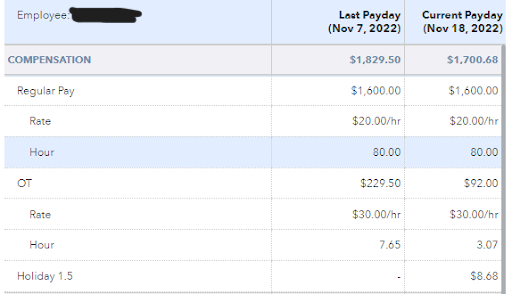

The first screenshot shows the employee’s paystub. The regular pay is $20.00 per hour. The employee worked 80 hours at the regular pay rate. You can also see that OT (overtime) is paid at $30 per hour. The employee worked 7.65 hours of OT. The next pay item (Holiday 1.5) shows that the employee received $8.68 of pay at $1/hr when the employee worked 8.68 hours and should be paid $260.40 at $30/hr.

My products: Quickbooks Online Plus, Quickbooks Time, Quickbooks Payrool Premium

Paystub (Quickbooks Online)

Quickbooks Time Pay Rates Rule

Appreciate your help! This has been driving me crazy for several hours.