Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am trying to update my Payroll Massachusetts COVID-19 Recovery Assessment Tax rate to the number I was just given (2.642%) but the system would not let me enter a value more than 1.796%. Can I override this limit?

Hello tp,

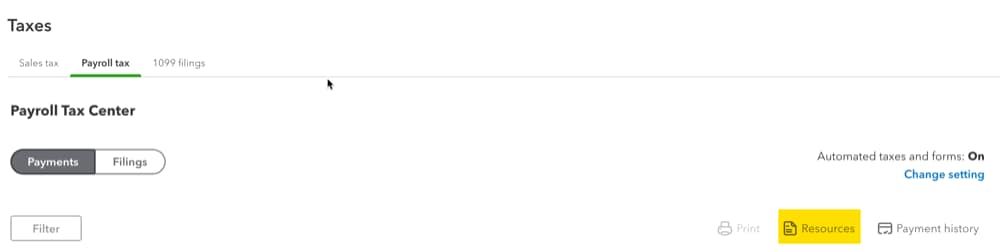

Thank you for connecting with us! Quick question, did you receive a notice with this information? If you use our payroll service, let's go ahead and send this notice to our tax team so they can rectify this issue. Here's how:

From here, we will send you an email confirmation and case number. Once completed, the tax specialist will reach out to you with any resolution or additional steps. If you want to see status updates about your case, this article will help you with that. I also encourage you to reach out to your local agency to understand this better or ask further questions.

Please let me know if you have any concerns. I will be looking out to your response about the notice. My team and I are here to assist you! See you soon.

I submitted the tax notice as suggested, In my Resolution Center, I see the request:

Thanks for following up with the Community, tp. I appreciate you performing SashaMC's recommended steps to get your tax notice submitted.

Intuit sends confirmation emails with case numbers and additional details once tax notices are received. Since you're not seeing an email from Intuit in relation to the notice you submitted, I'd recommend checking your spam and/or junk folders to see if any emails from Intuit were routed there by mistake.

Once Intuit completes a review of a tax notice, a specialist will email you about the required resolution, steps Intuit's taken on your behalf, and any additional actions that may be required.

If you're not finding any emails from Intuit about your notice in any of your email's folders, you'll want to get in touch with our Customer Care team. They'll be able to pull up the account in a secure environment and conduct further research with you into the status of your case and why you didn't receive an email.

They can be reached while you're signed in.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

Please feel welcome to send a reply if there's any additional questions. Have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here