A balanced deduction of Social Security Tax to both employee and employer is essential to avoid over-/underpayment and tax penalties, @strikeforce824. Allow me to impart information and then direct you to the right help.

You are correct that both the employee and employer share of Social Security Tax should be deducted equally based on the IRS rates and the worker's salary.

Since it happened that only the employee side has been taken out, and the employer part does not have a deduction, there is a need to have a deep check of your current setup and historical payroll data to review the calculations and limits.

If there are discrepancies, you will need to override them. To do this, you will need to contact the payroll support team since they are the ones who have access to correct them. Here's how:

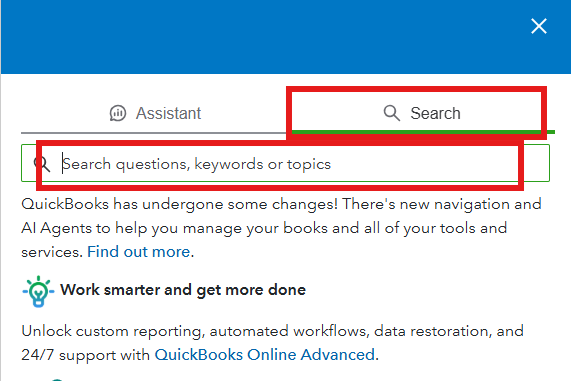

- Go to the Help Icon.

- Pick the Search tab. Type in your concern in the search field, and then click the Enter tab in your keyboard.

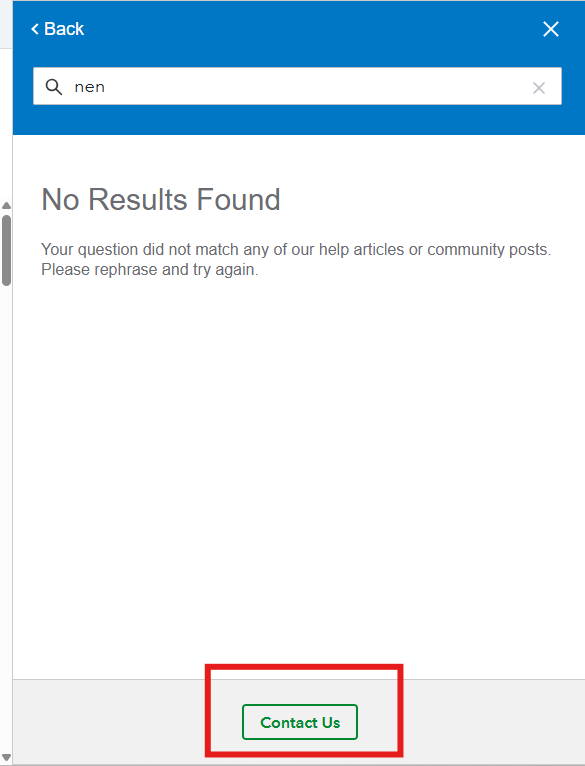

- Click Contact Us below.

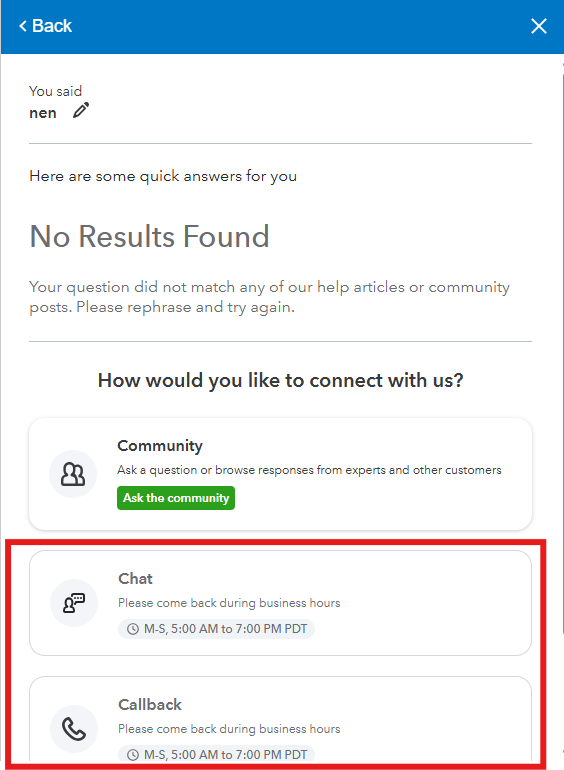

- Select either Chat or Callback.

Reach out back here if you have additional questions about your SS tax deductions and calculations because the balance of your payments is our utmost priority.