Glad to see you here in the Community and posting your concern, @userboophawaii. Let's work together and record those tips for employees in QuickBooks Online.

Beforehand, we'll need to determine first what kind of tips you're recording. If the tips that will be given to your employees are through cash, it's the Cash tip that we'll enter in QBO. Otherwise, if it's through a paycheck, we'll have to include the Paycheck tip option in your employee's details.

Once you've already figured it out, here's how you can record tips for your employee:

- Go to Payroll on the left panel.

- From the Employees tab, choose an employee.

- From the Employee details, click the Edit icon next to Pay types.

- In the How much do you pay section, select Cash Tip or Paycheck Tip.

- Click Done to save changes.

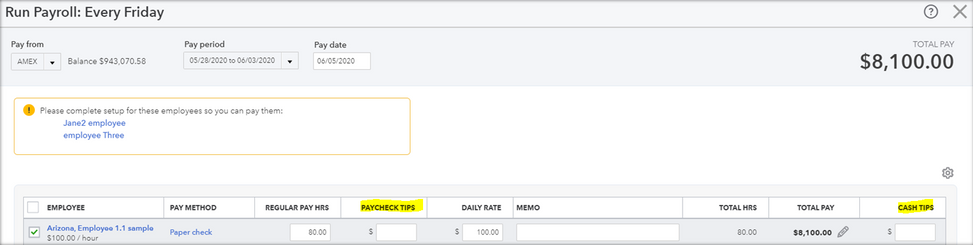

From there, we can now manually record the amount on each employee's paycheck within your QBO account. Please see this sample screenshot for reference:

For more details about the difference between cash tips and paycheck tips, please check out this article: Cash tips vs paycheck tips.

In addition, you can also visit this handy guide here to learn more on how to report your employee's earned tips: Pay and report tips.

Please let me know if you need clarification about tips, or managing your employees in QBO. I'll be standing by for your response. Have a great day, and stay safe.