I know changing your employees to hourly status, as suggested earlier, is not the right option since it can disrupt the consistency of their compensation, @LG45. With this, I want to provide information and alternatives you can consider to meet your compliance needs. Let's work together to find the best approach.

Since employees receive a predetermined fixed salary each pay period, the number of hours they work doesn't appear on their pay stubs in QuickBooks Online (QBO) Payroll. I understand the importance of this functionality for compliance with Illinois' state law that mandates providing information on employee paystubs, including hours worked. Therefore, I encourage sending feedback to our Product Engineers firsthand to consider adding it in the future. Here's how:

- In your QBO account, go to the Gear icon.

- Select Feedback.

- Enter your comments or product suggestions.

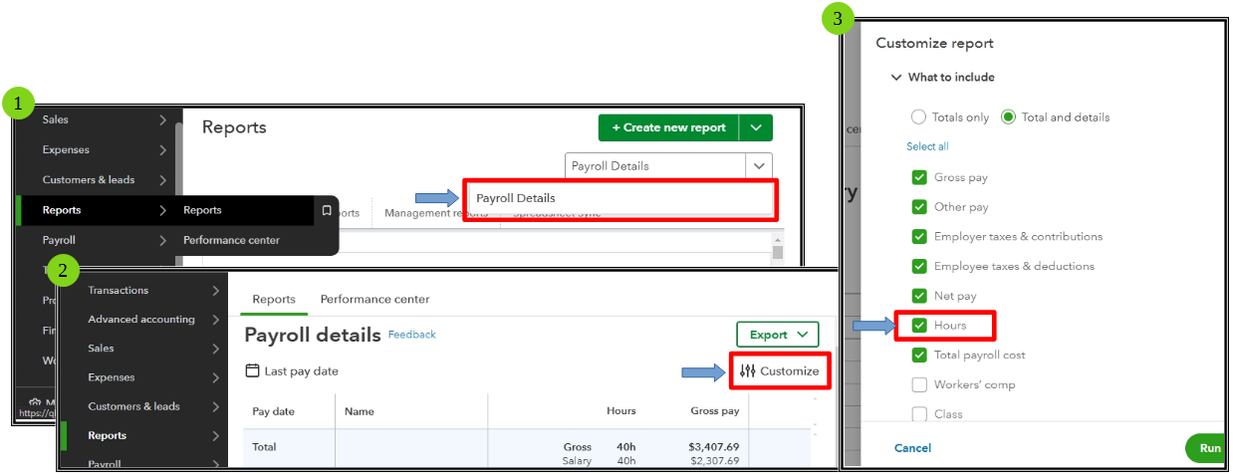

As a workaround, you can run a Payroll Details or Payroll Summary by Employee report. Then, attach it as a separate PDF document summarizing the hours worked for the pay period when you distribute pay stubs. In doing this, I also encourage communicating with your salaried employees about this and ensuring they understand how their hours are being tracked and reported. Here's how you can run the report:

- Go to Reports.

- Enter Payroll Details or Payroll Summary by Employee in the search field. Then, select the report.

- Select the pay date from the Date drop-down list.

- Click on Customize to filter the report to select Employee, Work location, or Workers' comp class.

- Tick either the Totals only or Total and details radio buttons, and ensure placing a checkmark for Hours.

- Hit Run report.

- Choose the Export button. Then, Print or save PDF.

If you need to wrap up your payroll processes and prepare for the new year, I'm adding this article as a future reference: Year-end guide for QuickBooks Online.

I hope the workarounds we discussed will help you comply with Illinois regulations without altering your salaried employees' status. Your feedback is important to us, and it helps us improve our services. If you have additional questions or clarifications you'd like to add, feel free to click on the Reply button and we'll be here in the Community to help. We're committed to offering ongoing support. Take care!