Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn Quickbooks Online Payroll, is there a way to set up a pre-tax deduction type, other than the preset options? And can we set that deduction to vary each pay period? I have an employee who is paid on commission, and her assistant's pay is deducted from that commission, pre-tax. And the deduction depends on the amount of the assistant's pay, which varies from one pay period to the next.

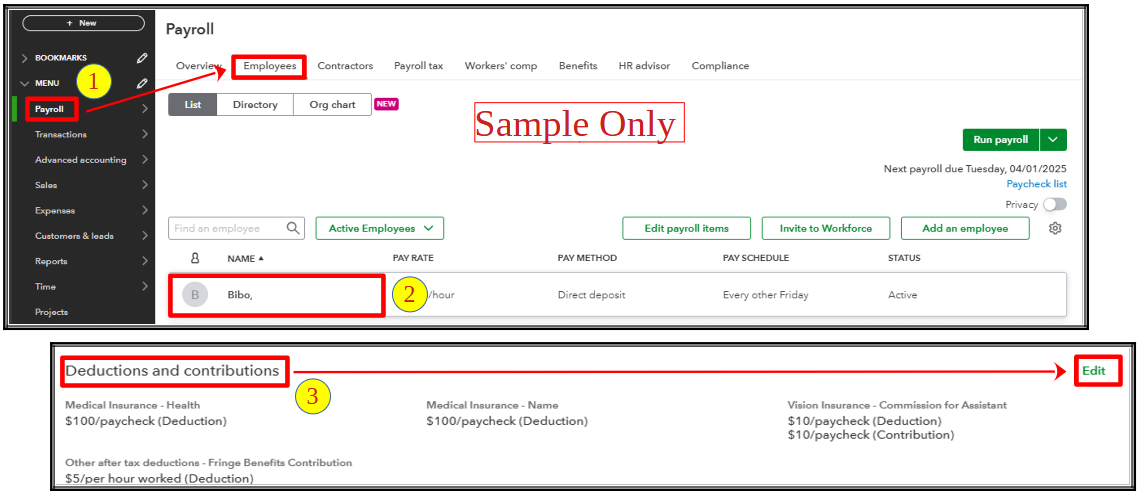

Hello there, Drew. Yes, it's possible to set up a pre-tax deduction in addition to the preset options by following a workaround. I'm here to guide you through the process.

Please note that since the deduction amount may vary based on the pay period or pay amount, you will need to manually adjust the payroll item as needed.

Here's how to set it up:

Please refer to this article for more details about the process: Set up, change, or delete employee-paid payroll deductions.

Moreover, to enhance your QuickBooks experience, consider collaborating with our Explore QuickBooks Payroll team. These financial professionals specialize in streamlining processes and providing tailored advice to meet your business's unique needs.

Additionally, you can run payroll reports to get a closer look at your business' finances.

Please return to this thread if you have other questions about the process, Drew. We're here to help you in any way we can.

Hey JanbonN, thanks for taking the time to reply!

What I understand from your response is that the answers to my questions are no and no.

There is no "other" category for pre-tax deductions, so any "other" items should be categorized as Vision Insurance. I understand that this option will allow for a pre-tax deduction. One has to wonder what impact the category of Vision Insurance will have on data logged under this deduction. If there is no impact, then what purpose does the categorization serve? If there is an impact, then I'd like to understand that impact before I log my data.

It seems like a pretty simple fix to add another option in the menu for "Other Pre-Tax Deduction" - the same option that is available in the after-tax deduction menu. It begs the question why Quickbooks' official guidance is to mis-categorize data.

In order to change the amount of the deduction each pay period, one must modify the payroll item, it cannot be done during the payroll process. What a hassle. There should be a deduction option that can be adjusted during the payroll process, just like most other payroll items.

Let me know if I have missed something.

Thanks again for your time!

Good morning, @DrewBARK.

Thanks for checking back with us. I hope you're having a great day so far.

You're correct with your thinking. The option for Other pre-tax deductions isn't available. For now, you would need to use the workaround my colleague has suggested above (step 6):

I think this is the perfect opportunity to send this suggestion to our Product Development Team. Our developers review each request and consider them all for future updates. If you would like to submit your feedback, please feel free to do so at any time using the link I'm including below.

Please don't hesitate to let me know if there is anything else I can assist you with. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here