I'll answer your questions about using payroll in QuickBooks, mlindekugel.

QuickBooks Desktop payroll subscriptions are usage-based. This means that you pay a monthly fee for updates, automatic tax calculation, tax forms, and payroll support. Then an additional per-employee charge of $2.00. Here's a link about this for more details: https://quickbooks.intuit.com/payroll/desktop/.

Alternatively, you can activate the manual payroll option. This will allow you to set up your employees and create paychecks at no extra cost. However, you'll be the one to calculate the tax and file the forms outside of QuickBooks.

Let me share these steps with you:

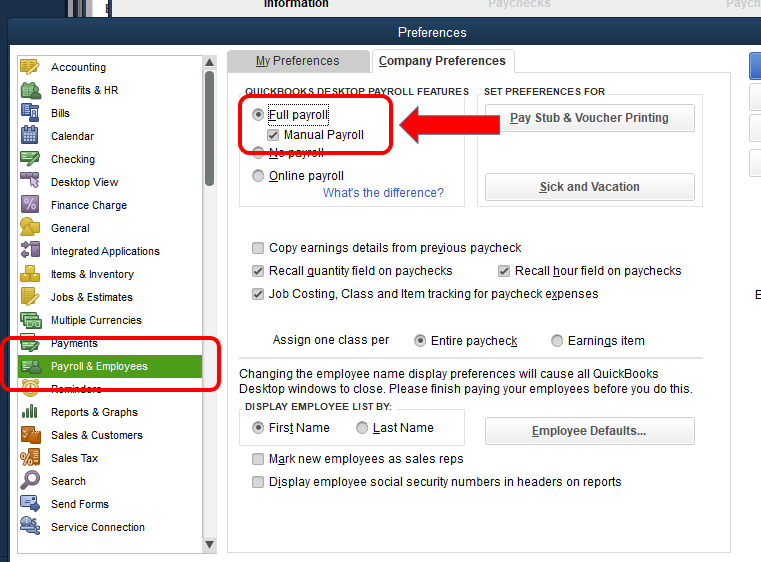

- Go to the Edit menu and choose Preferences.

- Select Payroll & Employees, then proceed to the Company Preferences tab.

- In the QuickBooks Desktop Payroll Features section, check the Full payroll and the Manual Payroll checkboxes.

- Click Next and then Activate in the confirmation screen.

- Select OK to apply the changes.

You can use these articles as references as well:

Let me know if that's all the information you need when running payroll. You can always post follow-up questions if you need anything else.