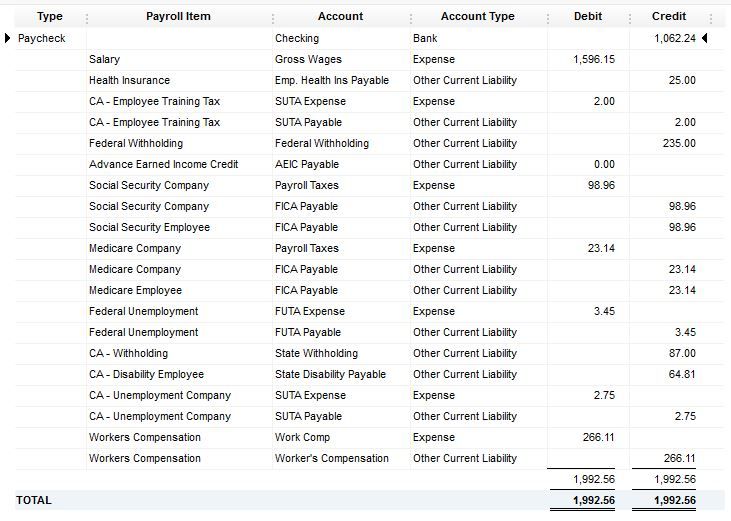

A good way to see how the Journal should look for your payroll is to look at how a the accounting for single paycheck works in QuickBooks.

Here's an example:

Note that the employee taxes use only a liability account, as would something like the employee 401k contribution, but the company paid taxes like Medicare Company have both a debit to an expense account and a credit to a liability account. This may be where the bank import doesn't work as banks (oddly) often don't think in terms of GAAP debits and credits.