Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowPaying payroll liabilities in QuickBooks is a simple process, Markfoust. Happy to outline the detailed steps with you to achieve your task.

Your subscription will determine how you pay payroll liabilities. If you have a QuickBooks Online Payroll membership, you can pay your liabilities by paying your taxes.

Go as follow:

If you don't have a payroll subscription, I suggest creating a check (non-tax liabilities) or a Journal Entry ( taxable liabilities). For complete steps, visit the following links below:

Also, check out the articles below to learn how to fix a tax underpayment, delete a tax payment, and deal with other similar concerns:

Let me know if you need any other help with this topic. I'll be right here if you need anything else. Have a good one!

But how do you pay non tax payroll liabilities? Is there a screen like desktop to let you know what you have withheld and when to pay them?

I'll share some tips on you can obtain that, angela-zacchini-.

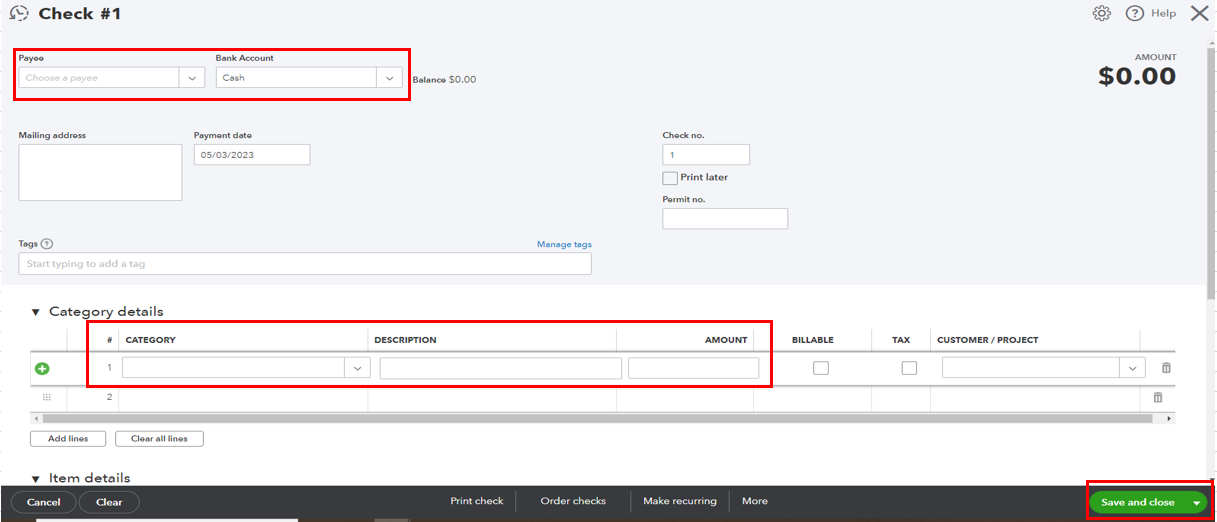

Currently, QuickBooks Online(QBO) won't automatically create a check to pay non-tax liabilities such as health insurance premiums, 401(k) contributions, and child support. However, we can manually make a check for these payments in QuickBooks.

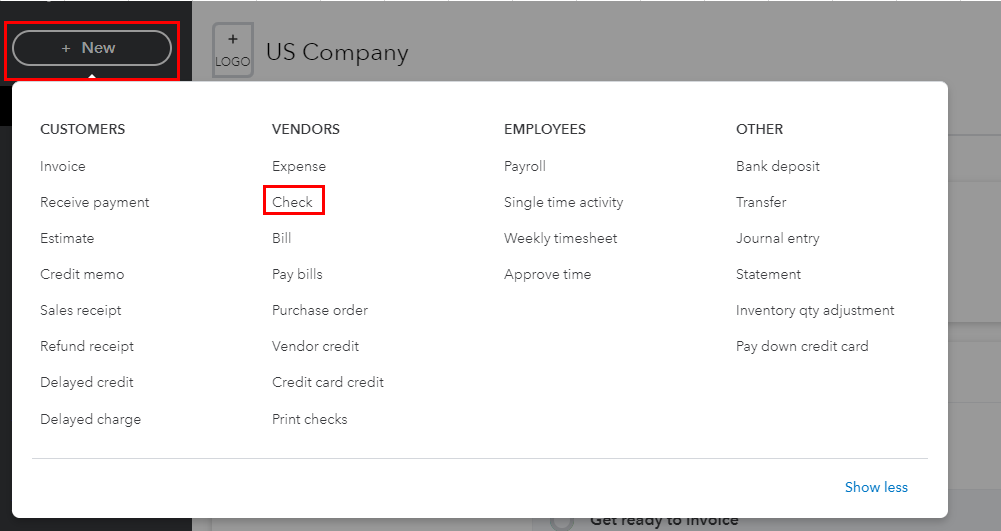

Here's how:

Additionally, we don't have the option to know what we have withheld and when to pay them in QBO. We recognize the importance of this feature to our users. You can send feedback requests to our Product Development Team so they can check and consider this in future updates. I'll show you how to do it.

In the meantime, we can run the Payroll Deductions/Conributions report. It'll give you a closer look at your employee's total wages, deductions, and tax information in a certain period. Just go to the Reports menu, then search Payroll Deductions/Contributions.

You can also run the payroll report to know your liability. It includes the description of each data and the information you can get.

Let me know if you have any clarifications about payroll taxes. I'll be with you to assist you further. Take care, and have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here