Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have 5 old red flags from Federal 941 payments. The funds were retained by us as part of the ERC reimbursement program. So they will never be paid out. Is there a way to remove these old reminders?

Thanks!

Solved! Go to Solution.

Hey there, Flexduct.

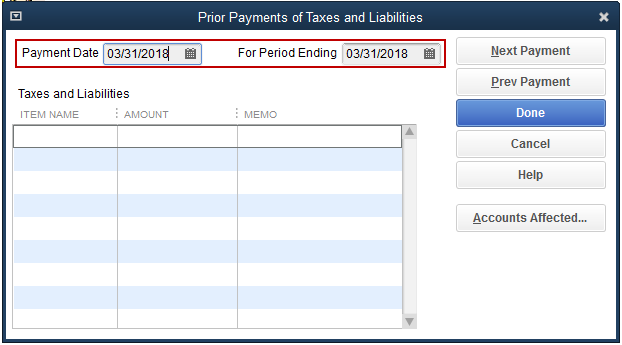

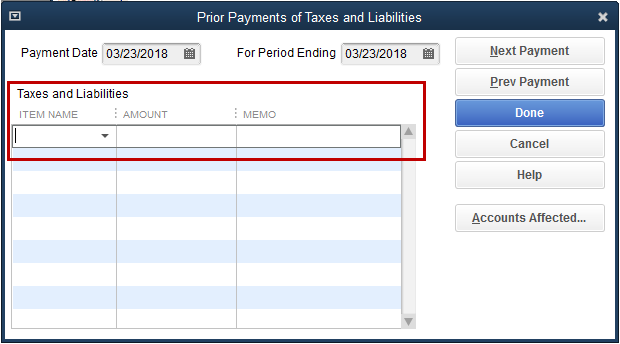

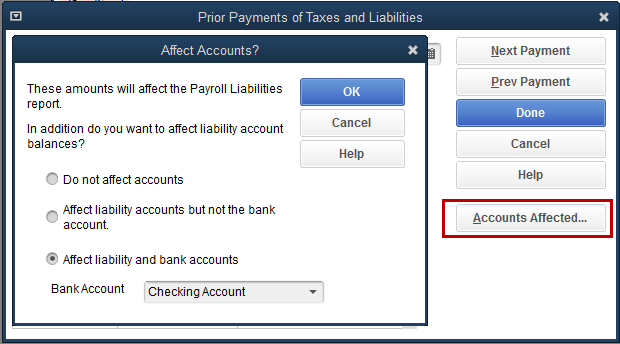

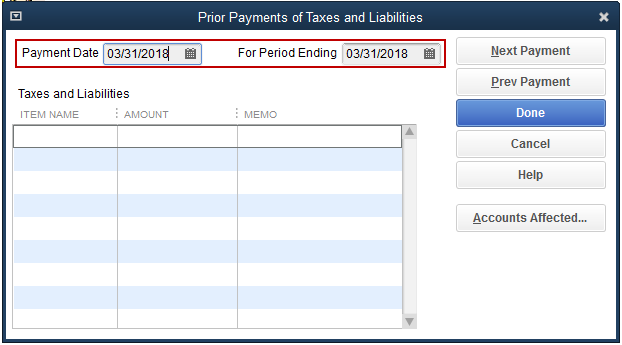

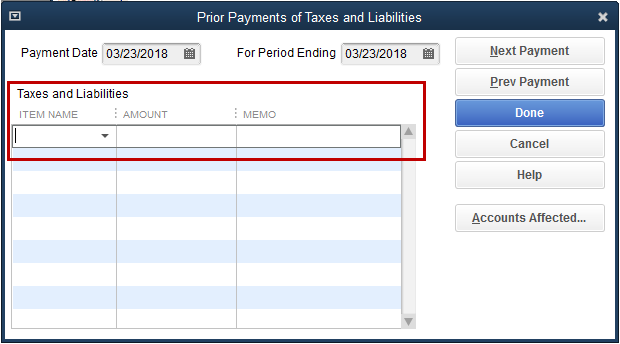

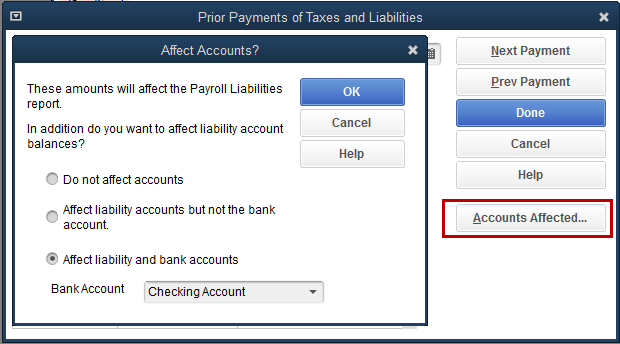

You can use the Enter Prior Payments feature in QuickBooks Desktop to remove the old reminders. Here's how:

To know more about this process, you can read through this article: Enter historical tax payments in Desktop payroll. This will provide you other ways on how to record tax payments as well as a link to access your historical payroll data.

I want to be your main point of contact, so please let me know if you have any other concerns or questions. Please know I'm ready to assist further. Have a good one.

Hey there, Flexduct.

You can use the Enter Prior Payments feature in QuickBooks Desktop to remove the old reminders. Here's how:

To know more about this process, you can read through this article: Enter historical tax payments in Desktop payroll. This will provide you other ways on how to record tax payments as well as a link to access your historical payroll data.

I want to be your main point of contact, so please let me know if you have any other concerns or questions. Please know I'm ready to assist further. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here