Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have a small business. I am currently searching for a health insurance plan. One of our employees does not currently have insurance. I would like to help them with medical bills. I have been researching laws for Ohio. It looks as if I could just do a bonus, but take taxes out of it. Do I need to set anything up differently with Quickbooks? I already do quarterly bonus's so just thinking I could do it the same? I have Quickbooks Desktop 2024 Pro Plus.

Thanks for reaching out with your question, @missmissySEI.

If you plan to help your employee with medical bills by giving them a bonus (rather than paying for health insurance directly), and you want taxes withheld from that bonus, you can generally handle it the same way as your existing quarterly bonuses in QuickBooks Desktop 2024 Pro Plus.

Since this bonus will be considered taxable income to your employee, make sure to enter it as a payroll bonus. This ensures that QuickBooks calculates and withholds the applicable taxes properly. Also, you don’t need to set up anything differently in QuickBooks specifically for this type of bonus.

However, if you decide to offer a company-paid health insurance plan in the future, you would need to set up appropriate payroll items for benefits or insurance deductions, depending on how your insurance premiums are handled. QuickBooks supports the following health benefits:

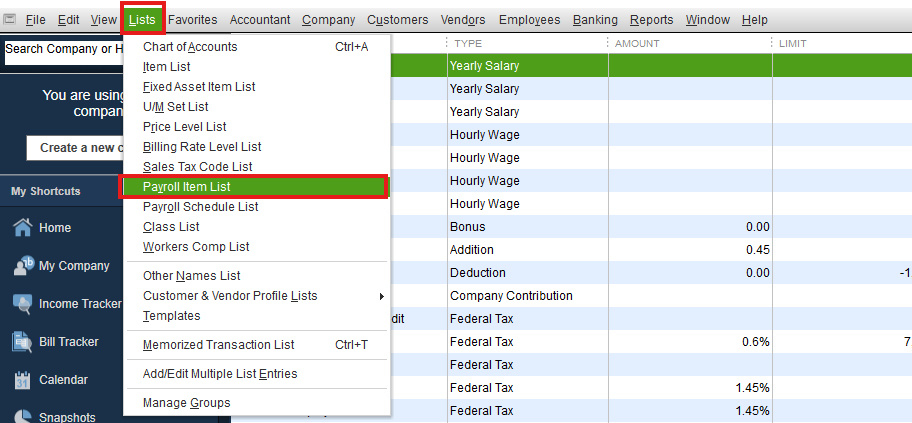

Once you know the details of the insurance benefits from your provider, follow the steps below to add a payroll item for medical, vision, or dental insurance. Here’s how:

For more detailed guidance on setting up and managing payroll items for insurance benefit plans, refer to this article: Set up and manage payroll items for your insurance benefit plan.

We’re always here to help you if you have any other concerns.

Thank you. That helps a lot.

It's great to see that you've found the information provided by my colleague helpful, @missmissySEI.

We are always here to assist you with managing payroll, including setup, bonus processing, or any other related needs.

Feel free to reach out anytime in the Community space. Wishing you a wonderful week ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here