Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Question regarding payroll on-boarding: We are switching our payroll service from Payroll Mate to QB Online Payroll effective 1/1/20. I would like to go ahead and on-board all of our employees' payroll info so that it will be ready to go for the first payroll of the new year. My concern is: Since i won't be using QB to process payroll until after the new year, should i report wages/tax payments from 2019? That's the first question that it asks me when i begin set-up. It seems like it would be a waste of time entering all of those numbers when they won't even be relevant in 2020 when we start using it. Any suggestions?

Solved! Go to Solution.

Thanks for sharing with us the details you want to achieve, @LindseyMem.

You'll need to complete your payroll data using your previous payroll software until the year ends before using QuickBooks Online (QBO) Payroll on January 1, 2020. This way, you won't have to enter your wages and tax payments from 2019 since QB just needs the 2020 data.

Also, make sure to submit your 2019 payroll to IRS to start fresh in QBO payroll and also to avoid any confusion in the future.

Then, if you need some data from your 2019 payroll, you can ask your old payroll software for assistance.

Also, I encourage you to visit our Employees and payroll taxes page to learn some tips and tricks on how QBO payroll works.

Should you have other queries with QBO, you can always leave a comment below. We're always here to help.

Thanks for sharing with us the details you want to achieve, @LindseyMem.

You'll need to complete your payroll data using your previous payroll software until the year ends before using QuickBooks Online (QBO) Payroll on January 1, 2020. This way, you won't have to enter your wages and tax payments from 2019 since QB just needs the 2020 data.

Also, make sure to submit your 2019 payroll to IRS to start fresh in QBO payroll and also to avoid any confusion in the future.

Then, if you need some data from your 2019 payroll, you can ask your old payroll software for assistance.

Also, I encourage you to visit our Employees and payroll taxes page to learn some tips and tricks on how QBO payroll works.

Should you have other queries with QBO, you can always leave a comment below. We're always here to help.

Need to talk to a live person to help with retrieving a payroll report.

getting very frustrated, in the past I've been able to speak to live person, is what I need

now. I'm spending too much time trying to get a live person, I have a great of other things

I need get done, but this is something I need to complete asap. Just need a report with the total

amount of income for each of my employees for the period of Mar 13,2020 to Mar 12th 2021

Can someone call me at [removed phone number], Norma

Hello, @1njhood.

I can help you get this report in your QuickBooks Online Payroll account.

You can pull up the Payroll Summary by Employee report and set the Date Range to Custom to enable manually pick the starting and ending date. This will show you the total wage of each employee.

Let me show you how:

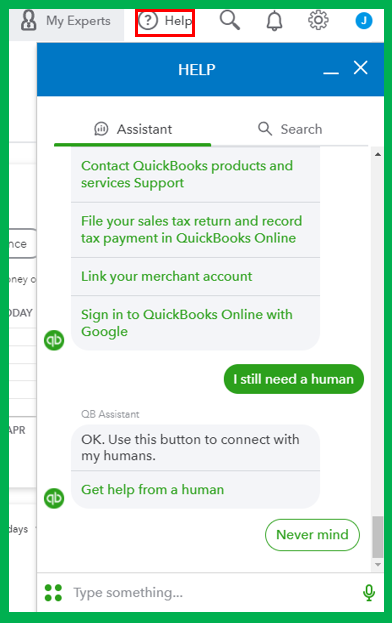

That will point you in the right direction. If in any case, you'll need to get in touch with our Payroll Support team, here's how to contact them:

Additionally, here are the articles that you can run through when you need a reference about our topic about a specific payroll report and how to reach payroll support:

If you have other concerns with running payroll reports, feel free to tag me with your comment below. I'm here to help you always.

Sadly this is not helpful

Thank you for posting here in the Community, @46-3814427.

Can you tell us more about the issue you're having today? I'll be sure to get back to you with a solution.

Here are some video tutorials that can help you achieve most tasks in QuickBooks Online: Video tutorials for QuickBooks Online.

If you're trying to enter historical information for your employees, please take note that it's only available for the current calendar year and there are no paychecks created for the employee(s) yet.

For more information about the process, consider checking out this article: Set up a prior payroll.

Please leave a comment below if you have any other issues or concerns. I want to make sure everything is taken care of for you. Have a great rest of the day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here